WorldSharp™ 1099 Preparation System

The WorldSharp™ 1099 Preparation System is used to import, enter, print and electronically report all 1099 forms. It has a robust data import capability. It prints data on preprinted forms or prints data and forms on blank paper. It allows you to file electronically with the IRS. The single user version is $89.95 and electronic filing and every form except 1042-S is included with every system.

Supported Forms (Select form for details)

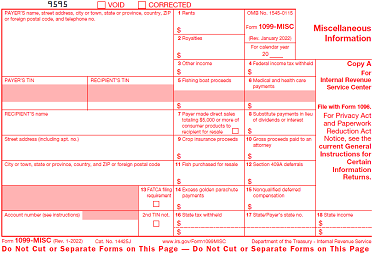

1099-MISC

Miscellaneous Income

1099-MISC forms are used to report miscellaneous income of $600 or more derived in the course of a trade or business from rents, prizes and awards, health care payments, crop insurance proceeds, payments to attorneys, fishing boat proceeds and a few other sources. It is also used if there are more than $10 in royalties paid.

Generally recipients are individuals, corporations or attorneys. The IRS instructions detail which recipients are required to receive a 1099-Misc.

You may click on the image above to enlarge the screen image.