The WorldSharp 1099/1042-S Preparation & Electronic Filing System offers a robust, professional solution for managing, printing, and electronically filing all 1099 forms. With advanced data import capabilities, the system allows users to efficiently enter or import 1099 data, print it on pre-printed forms, or generate forms and data on blank paper. Full support for electronic filing with the IRS is also included, making it a comprehensive tool for 1099 reporting.

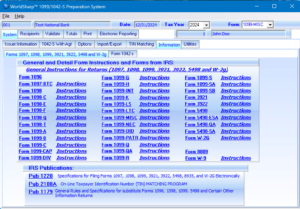

Supported Forms

The system supports a comprehensive range of tax forms, including:

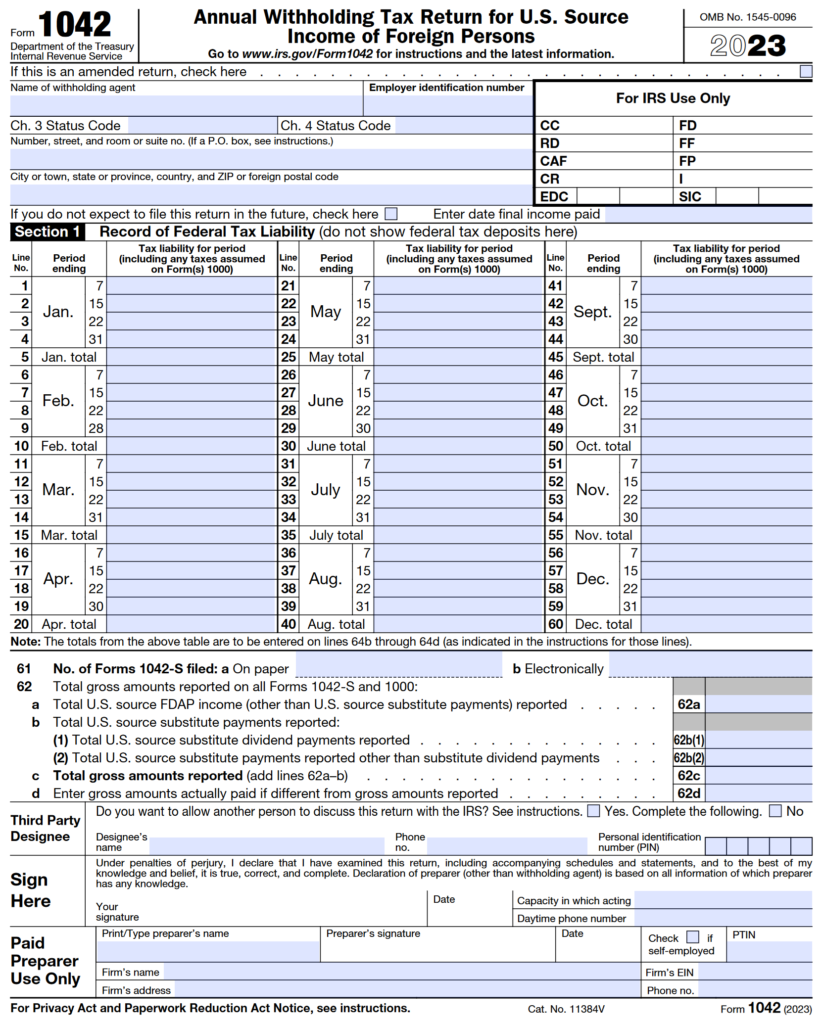

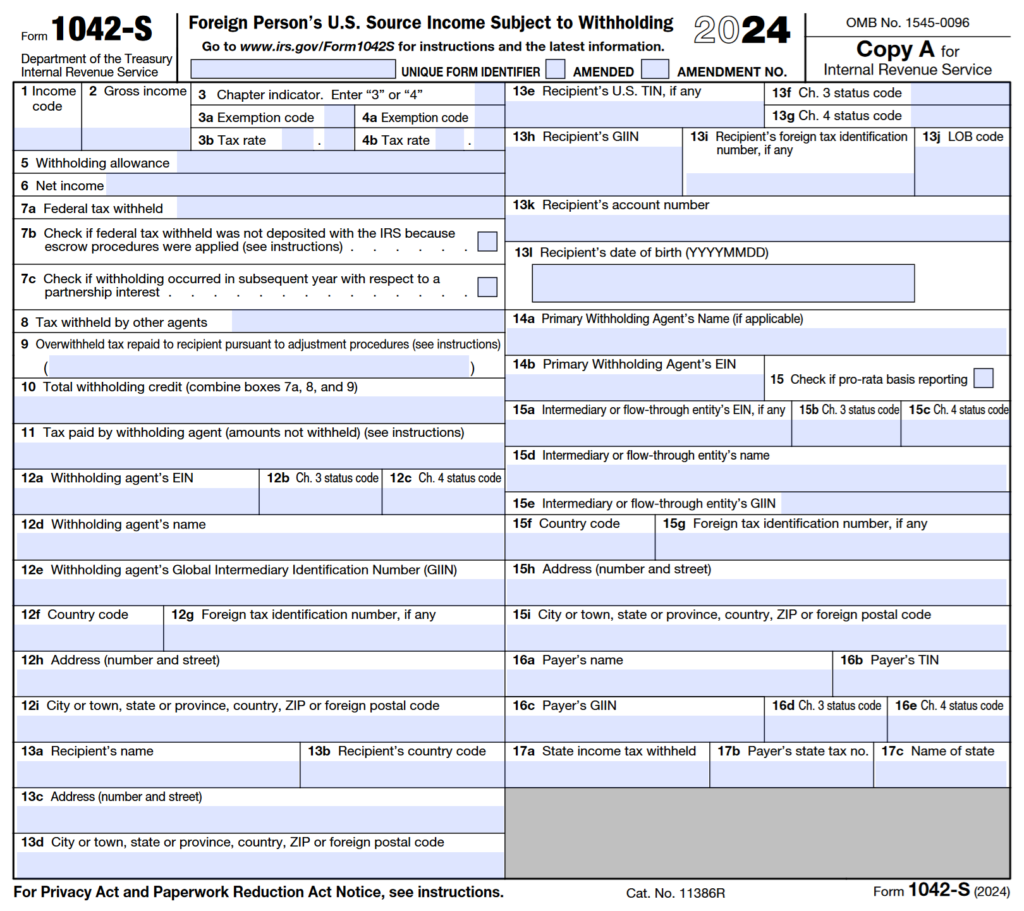

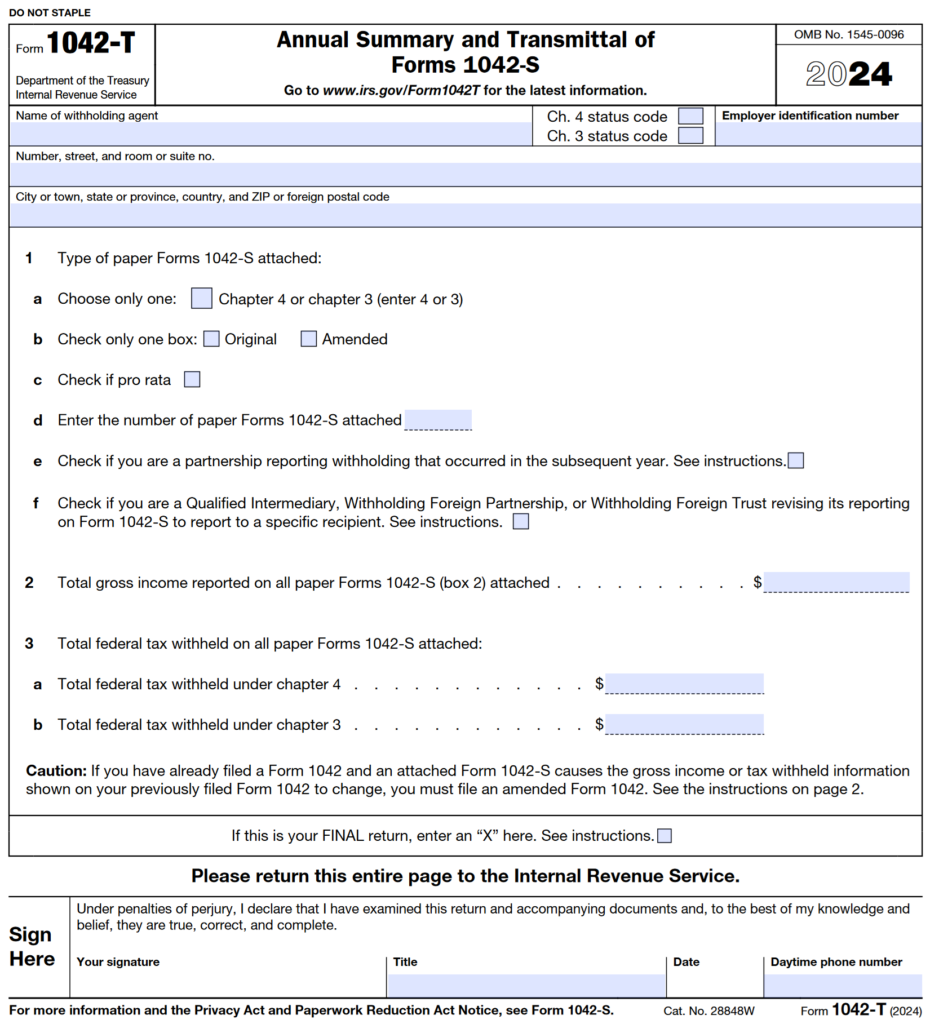

- 1042*, 1042-S*, 1042-T*

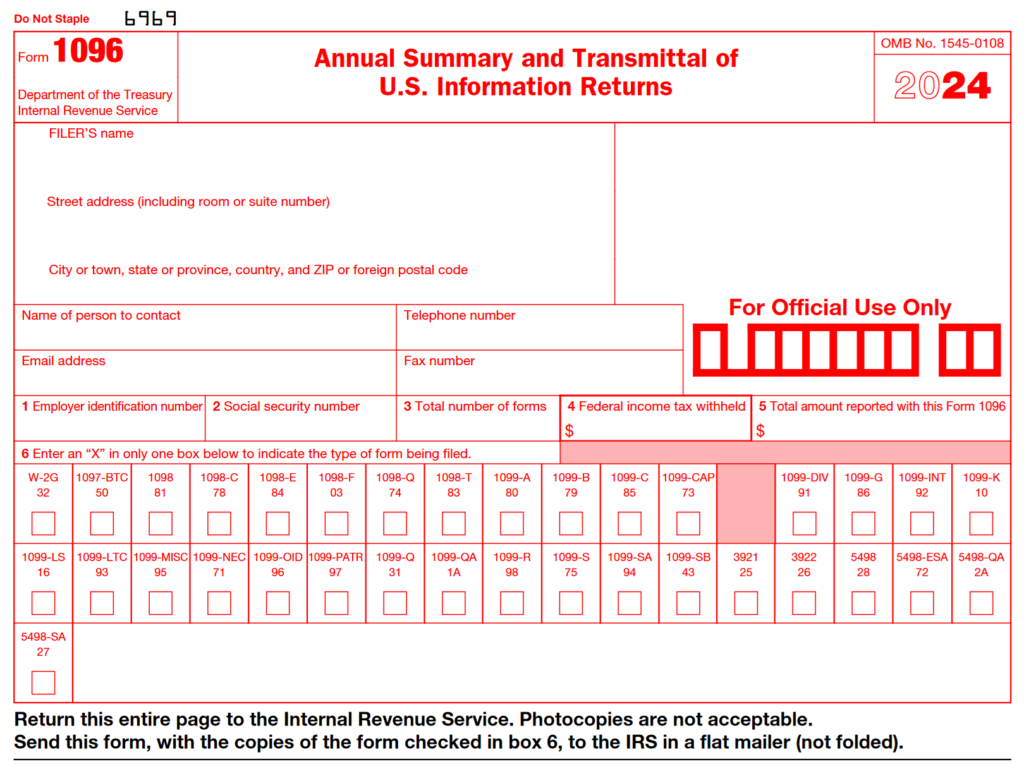

- 1096

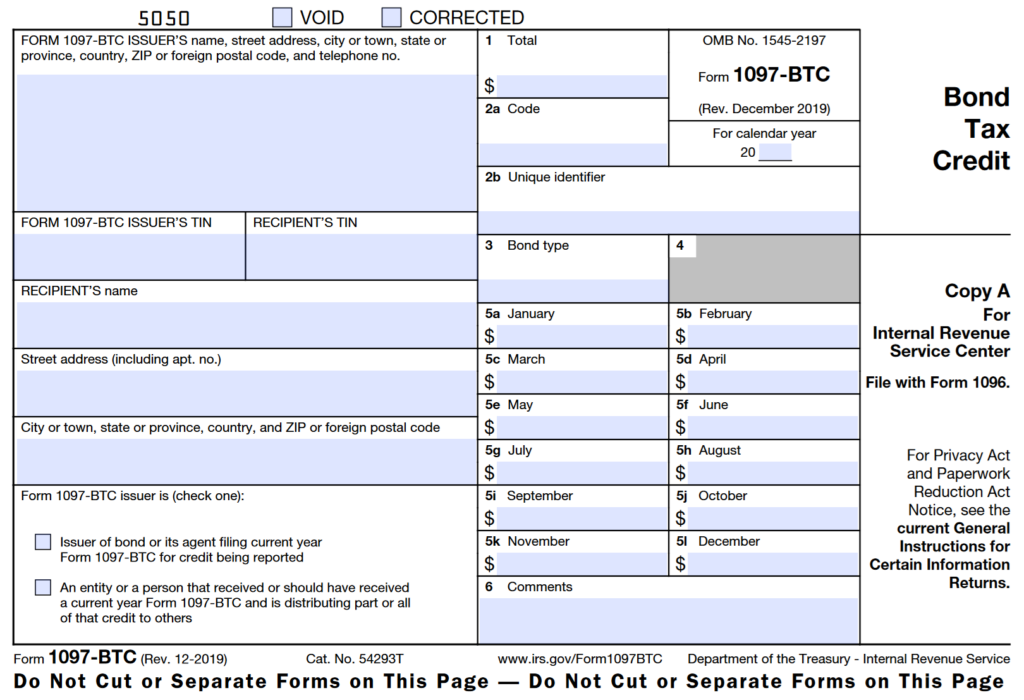

- 1097-BTC

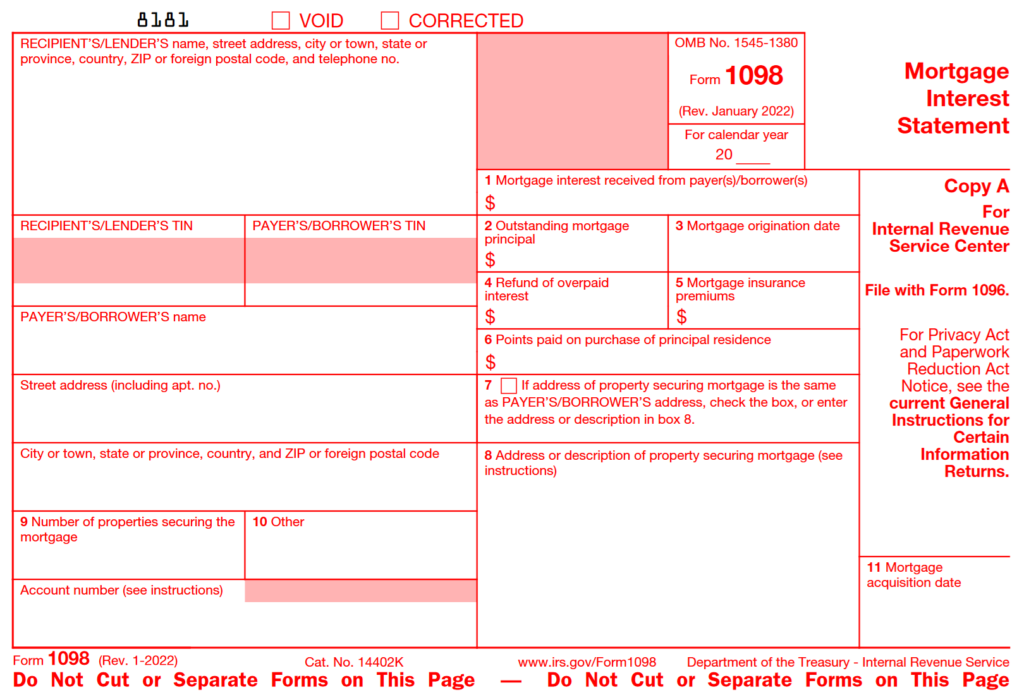

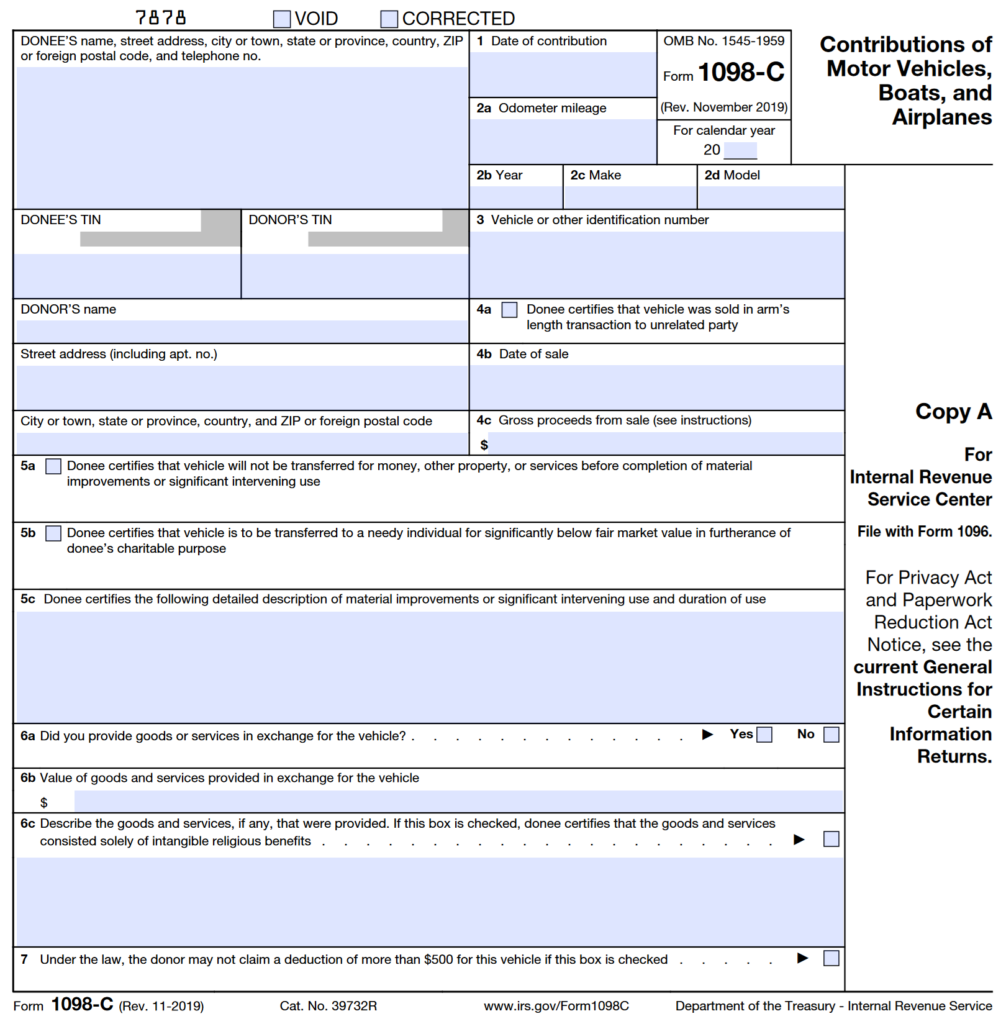

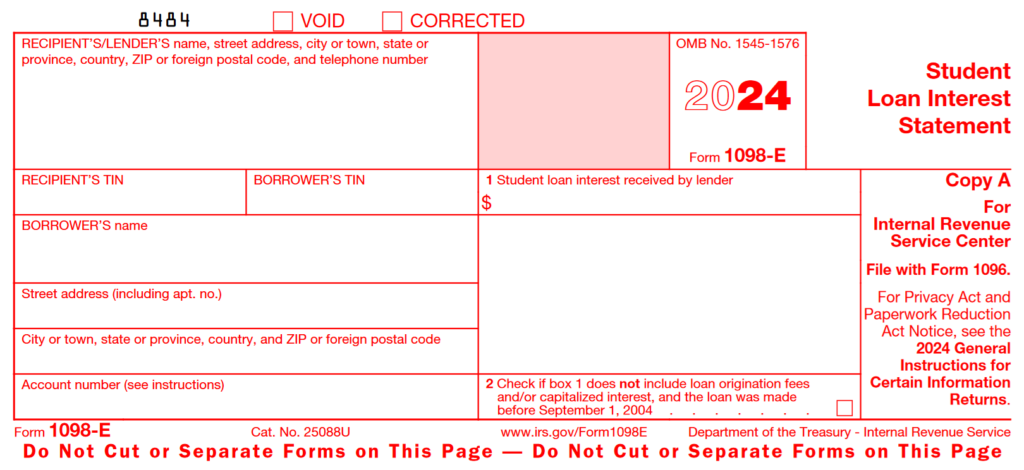

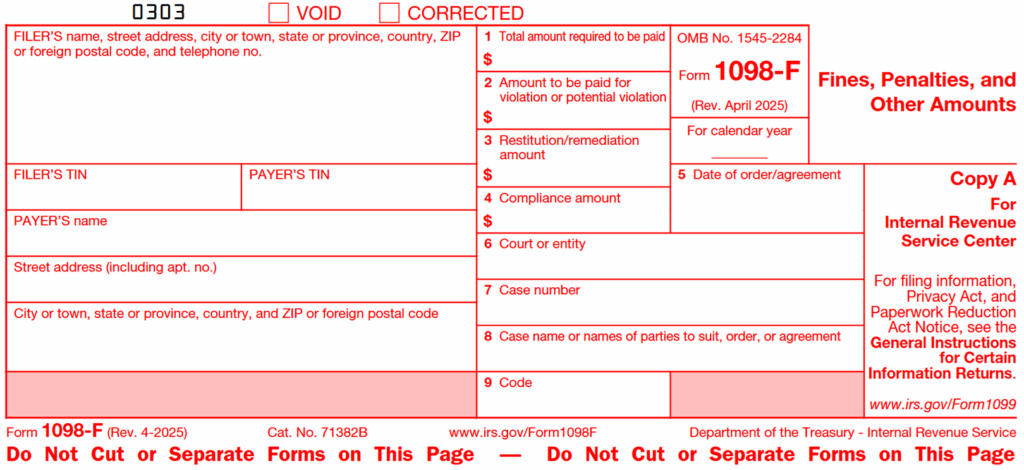

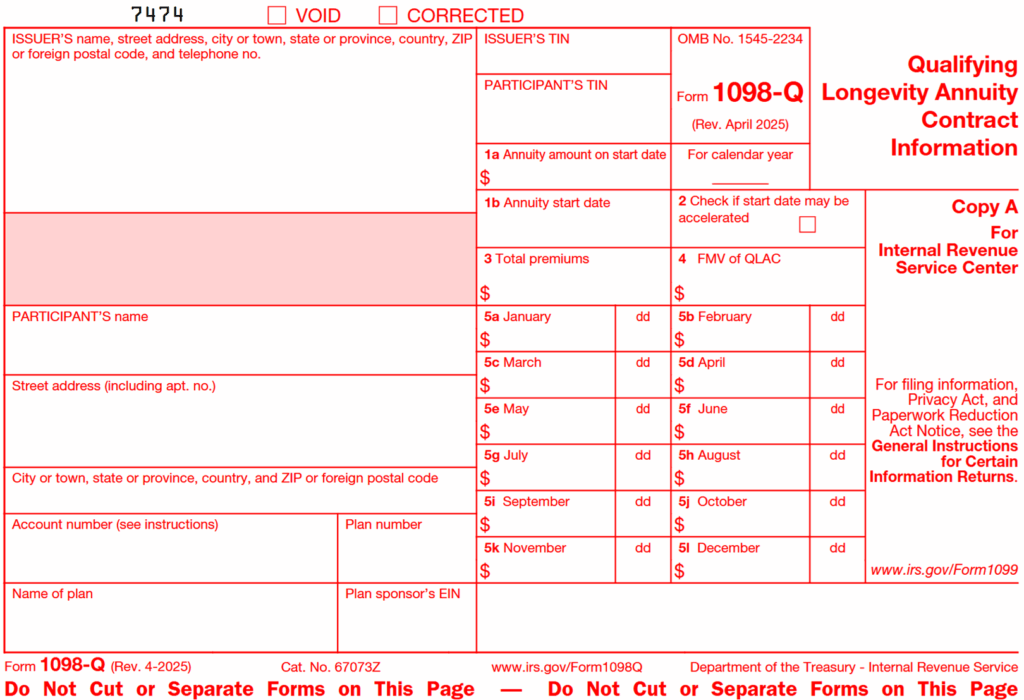

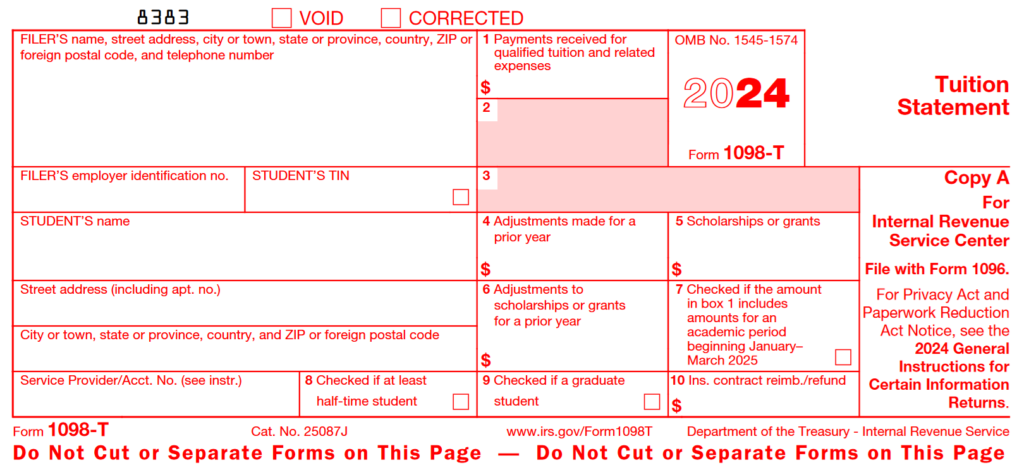

- 1098, 1098-C, 1098-E, 1098-F, 1098-Q, 1098-T

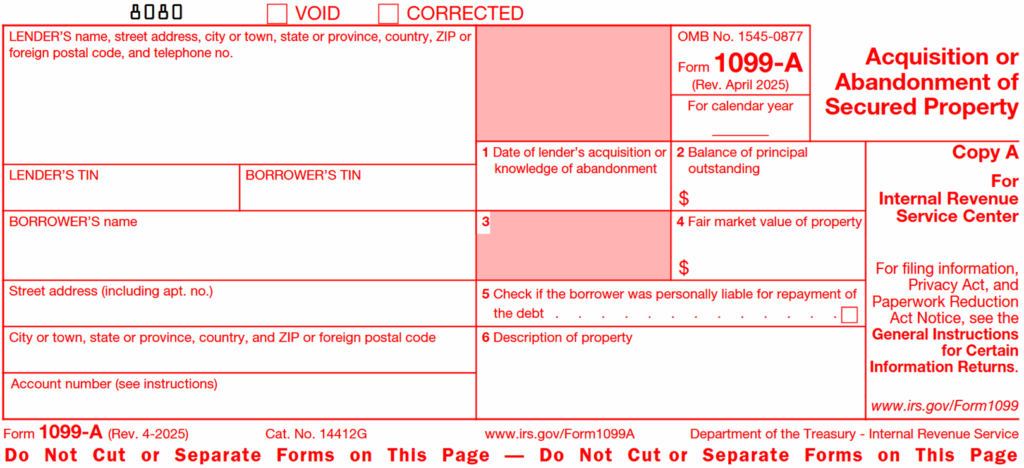

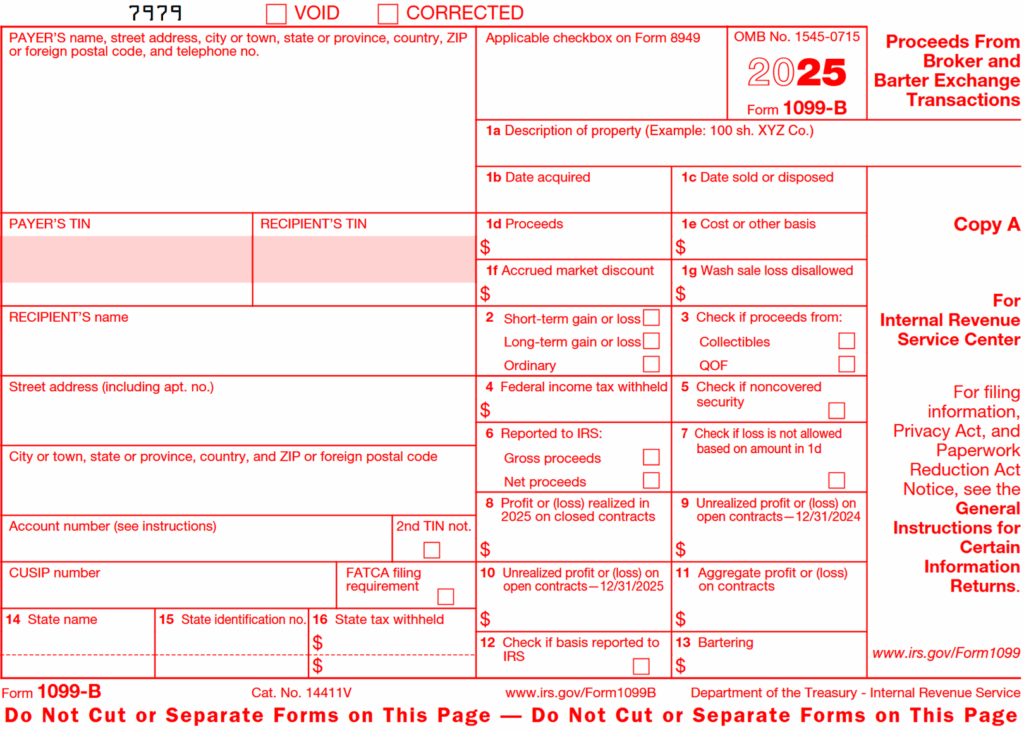

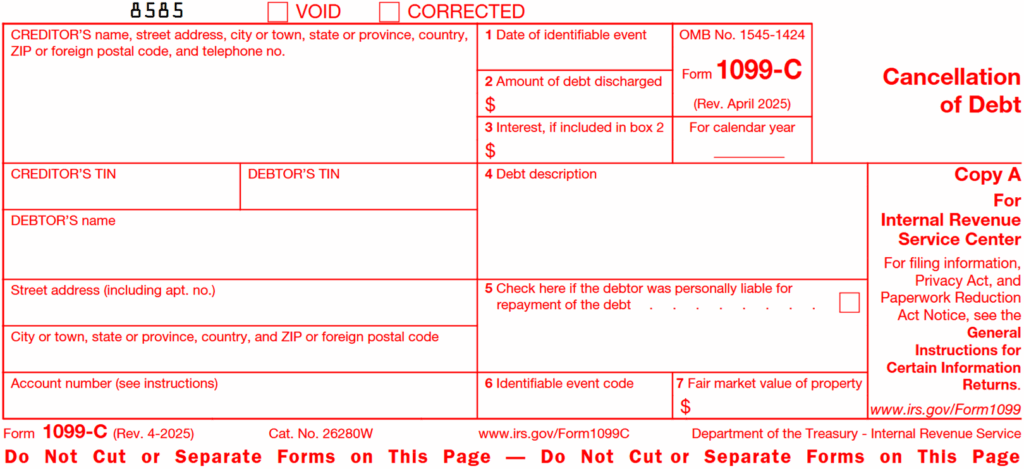

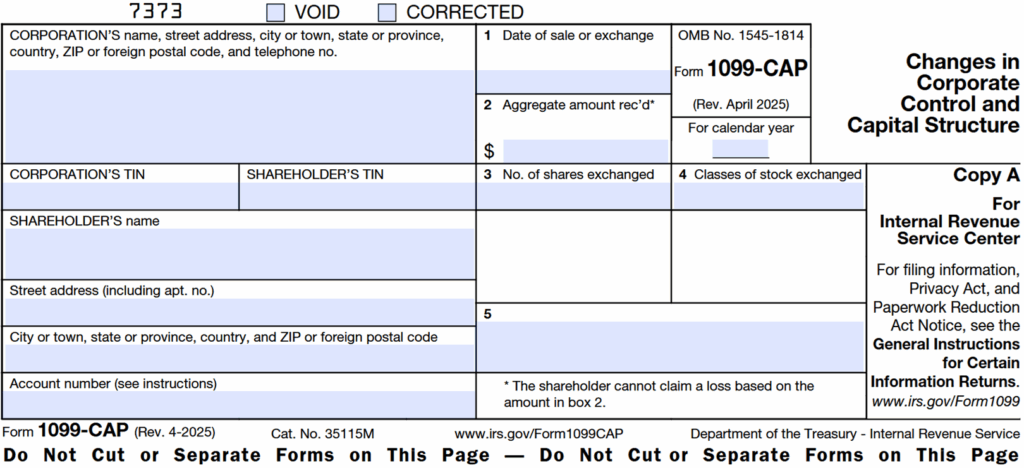

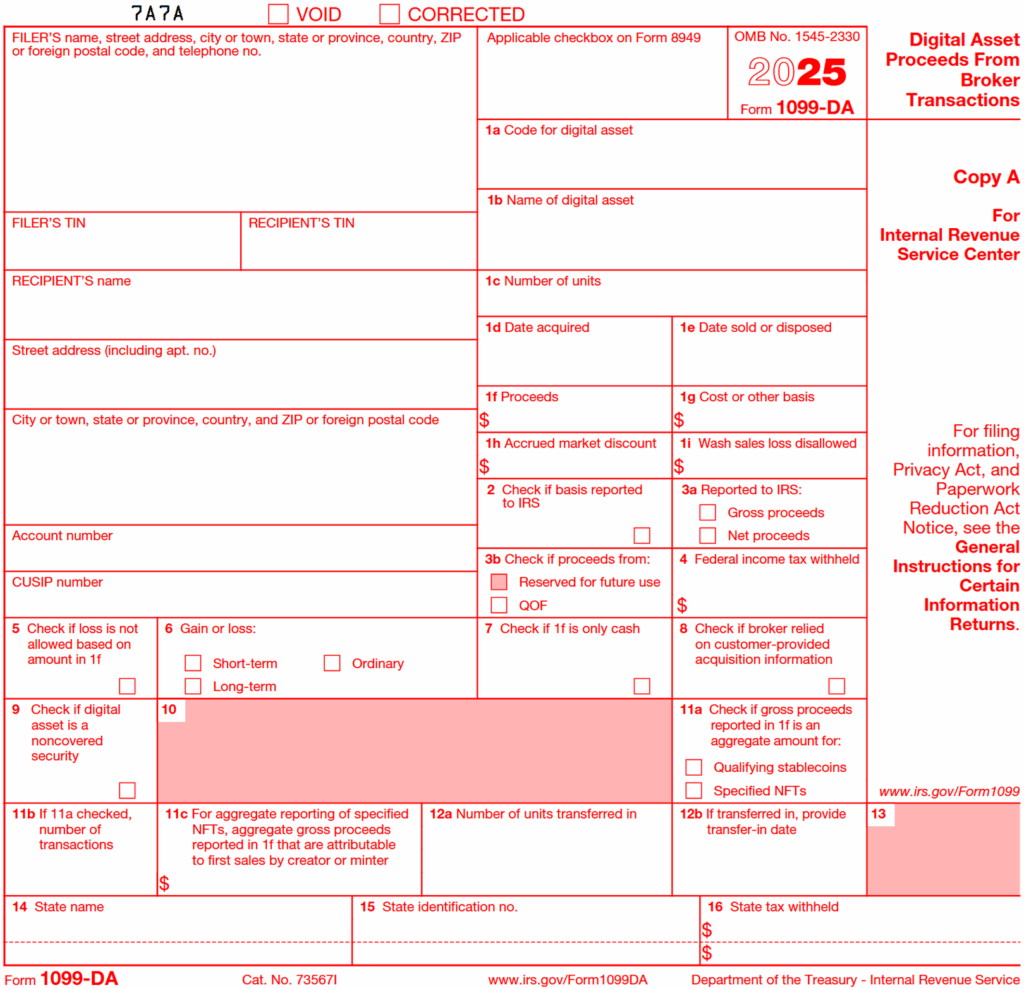

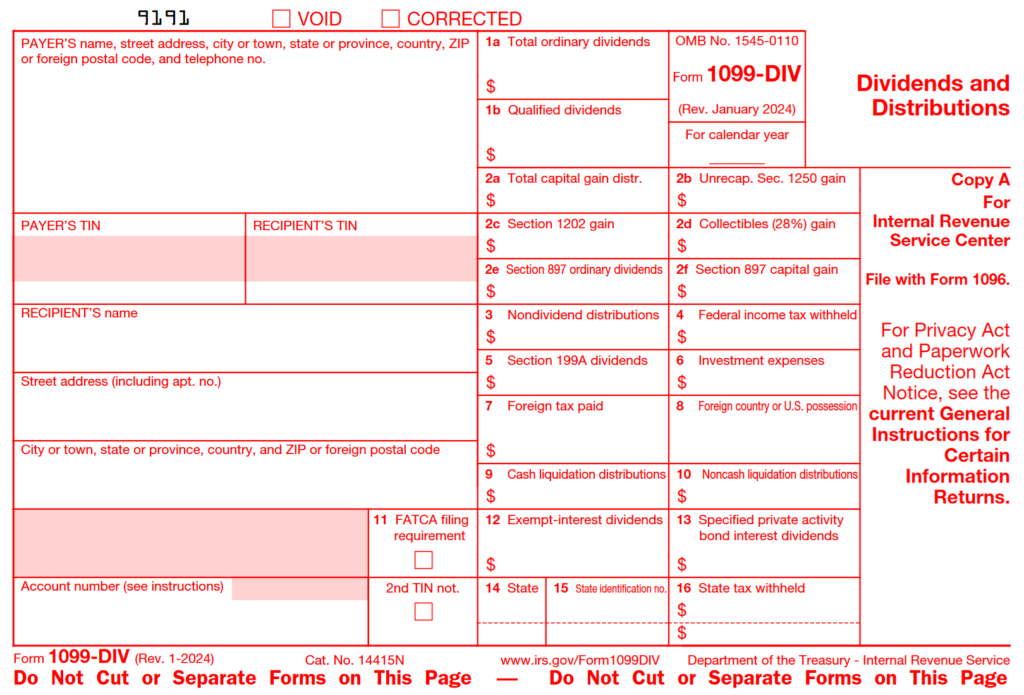

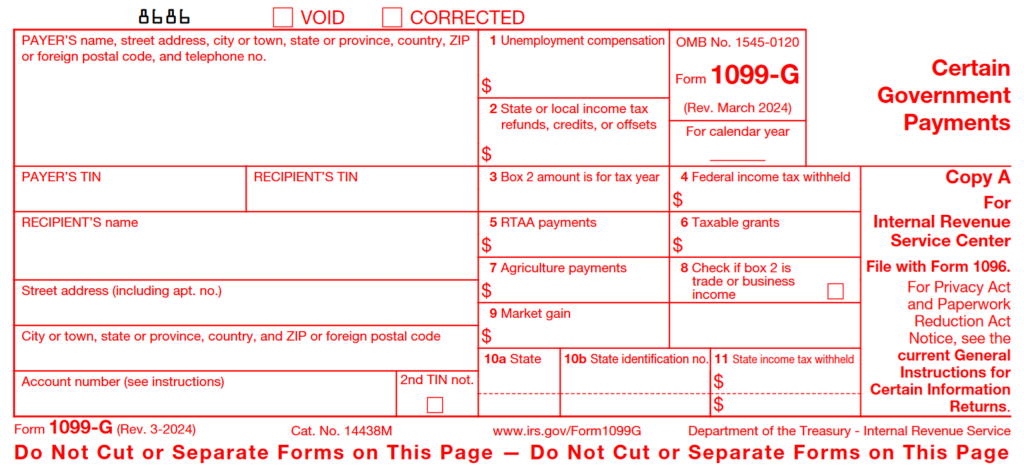

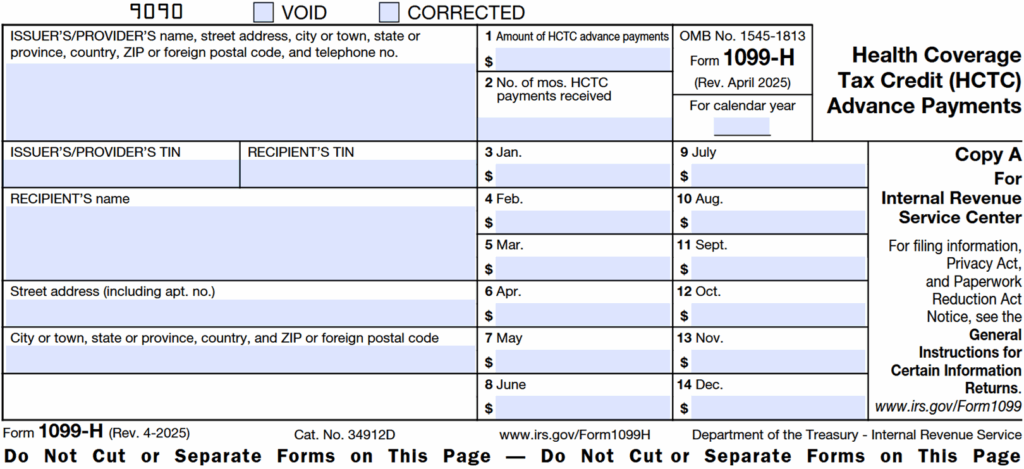

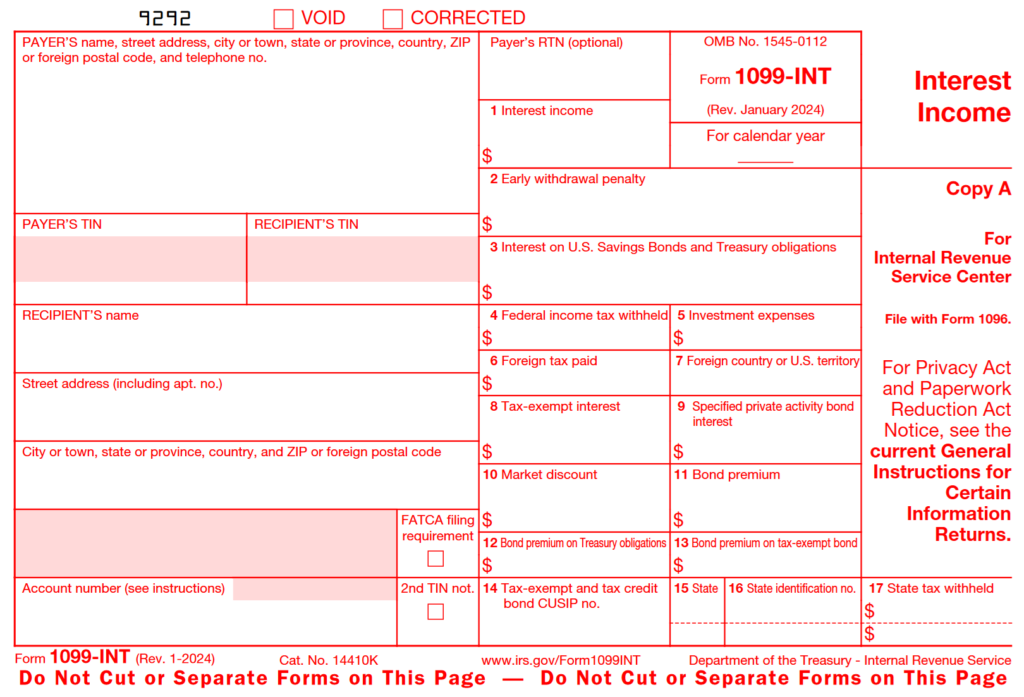

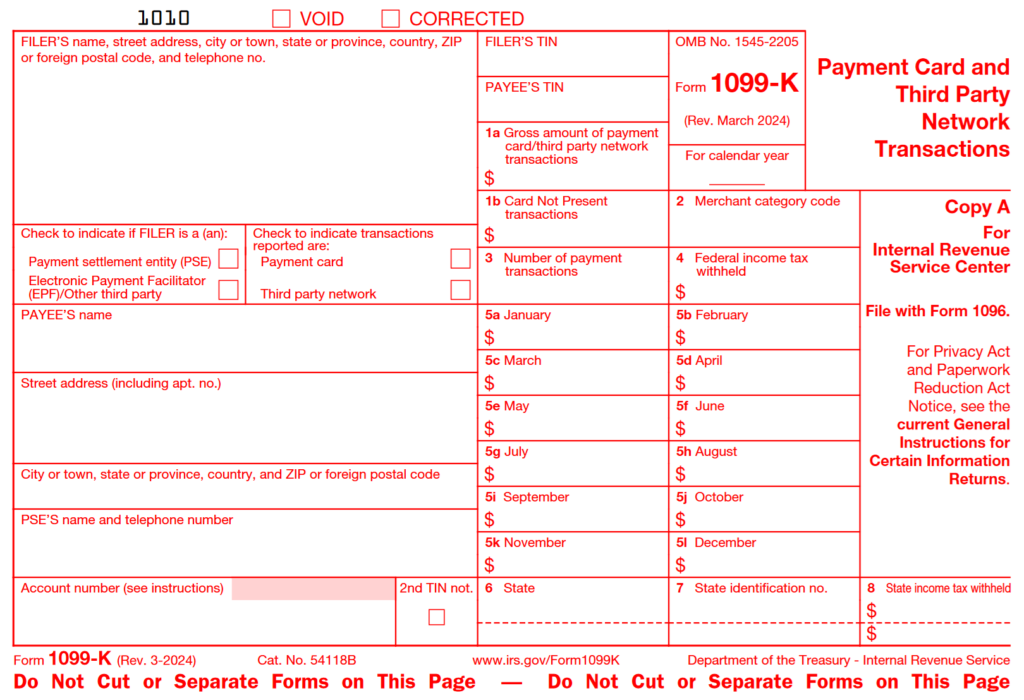

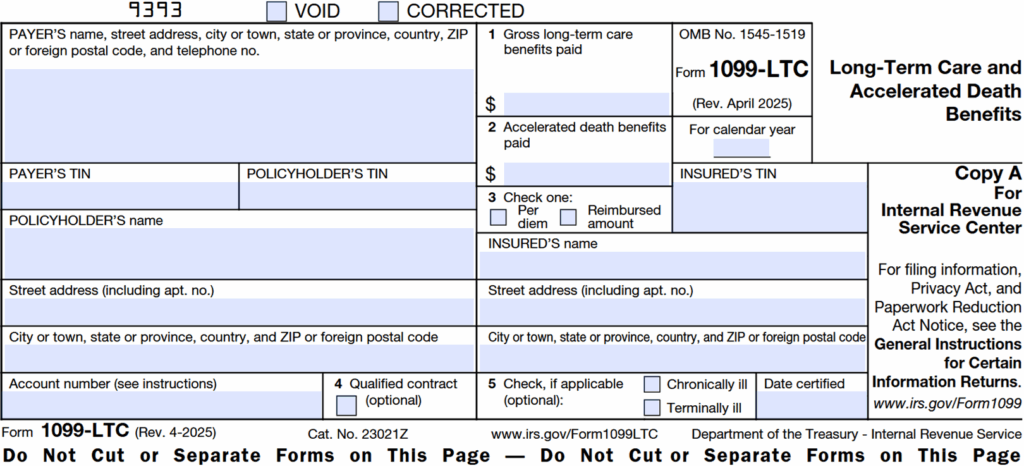

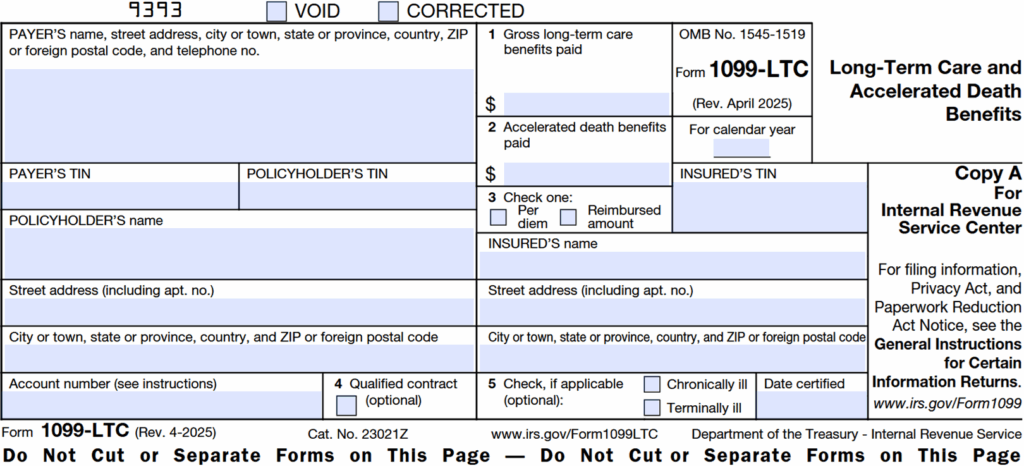

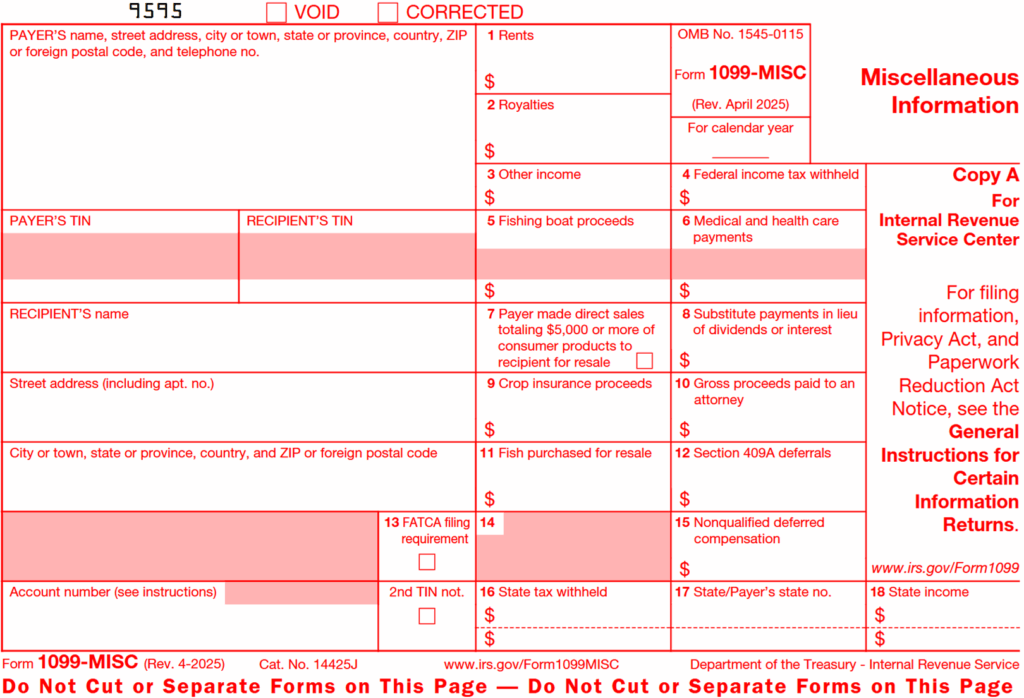

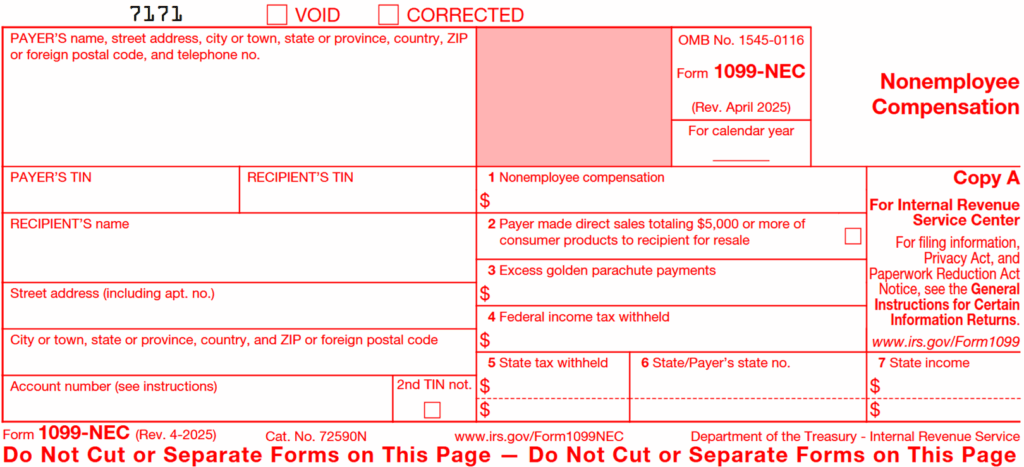

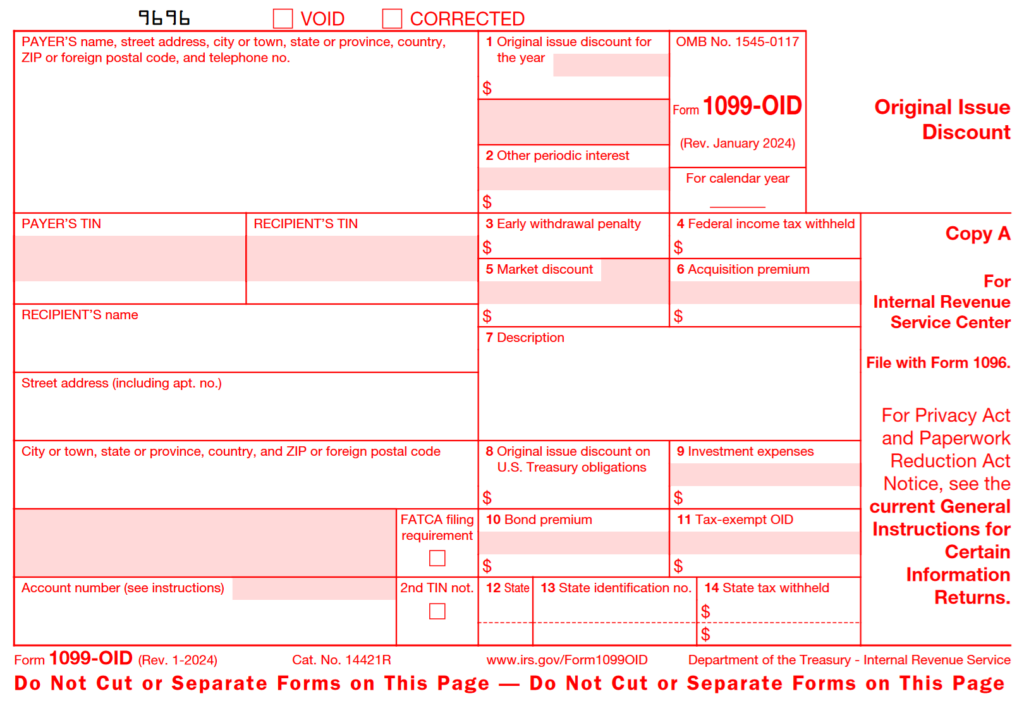

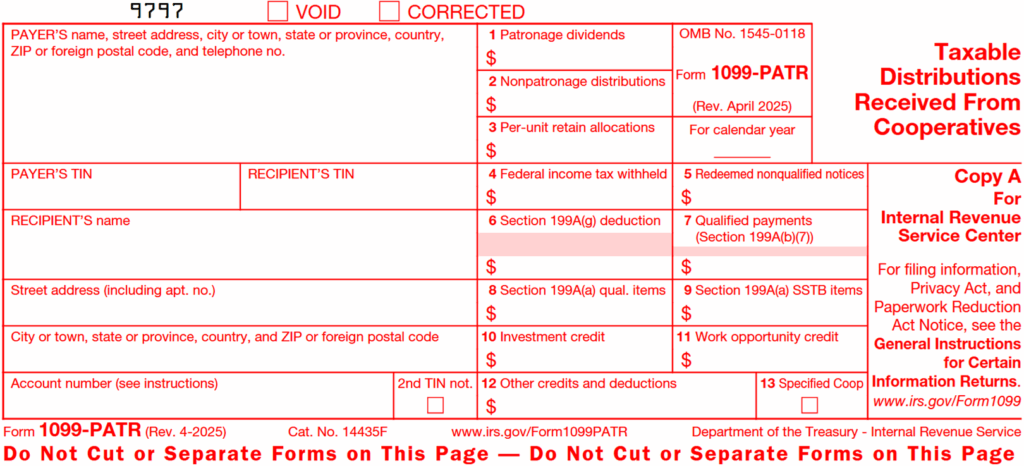

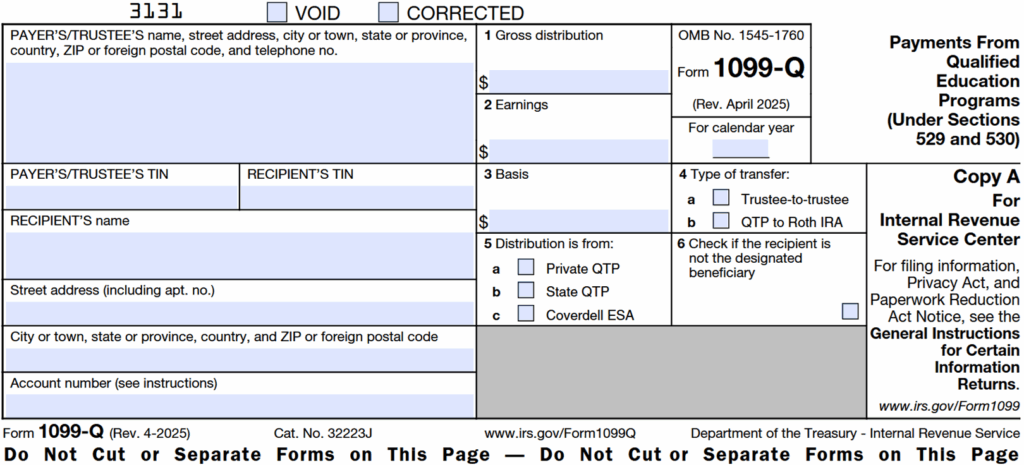

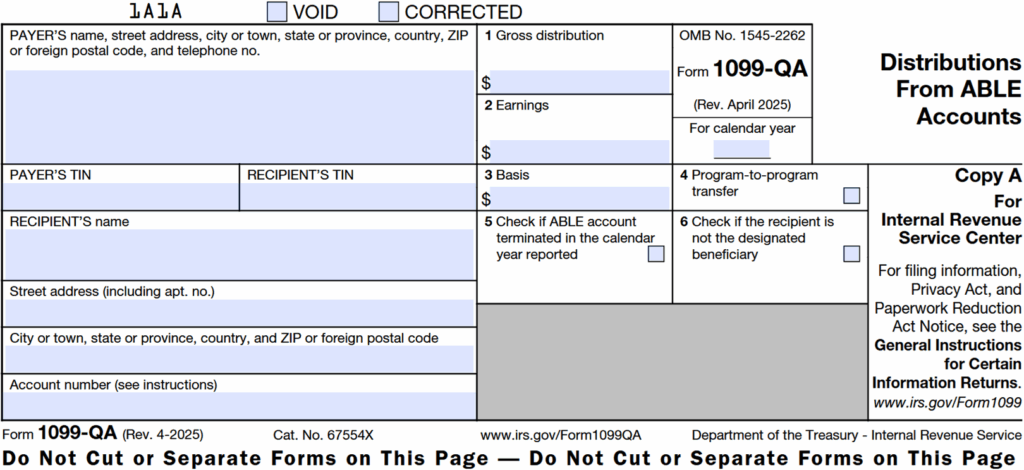

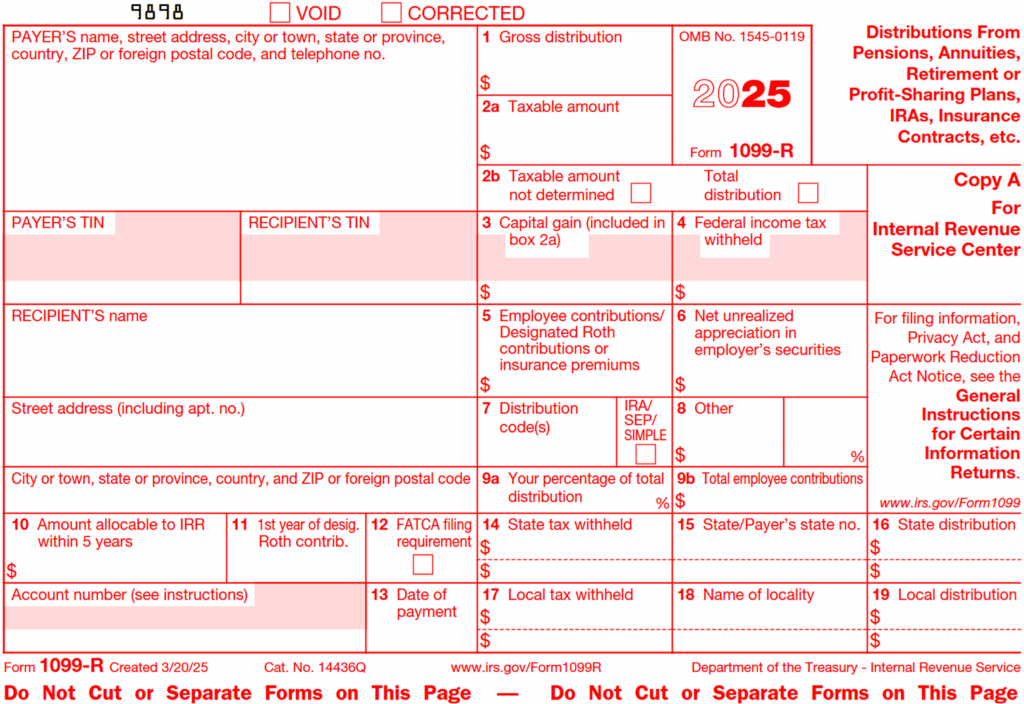

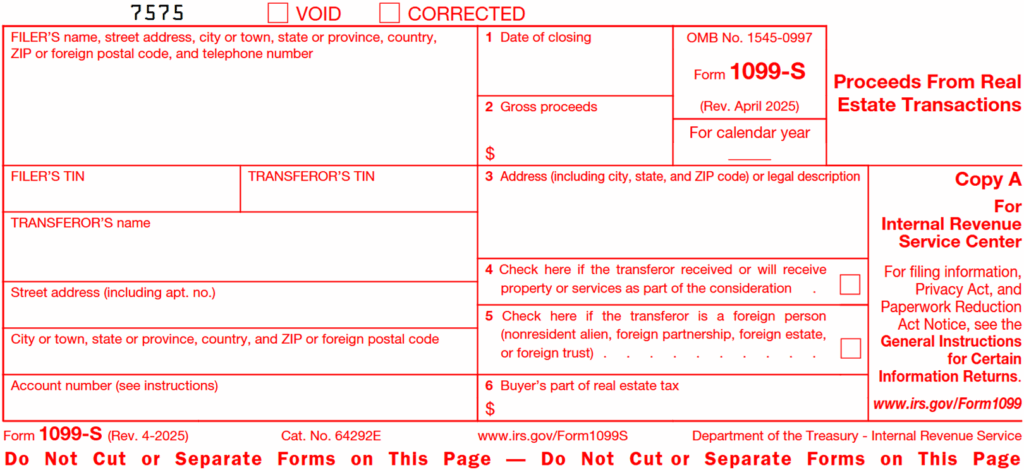

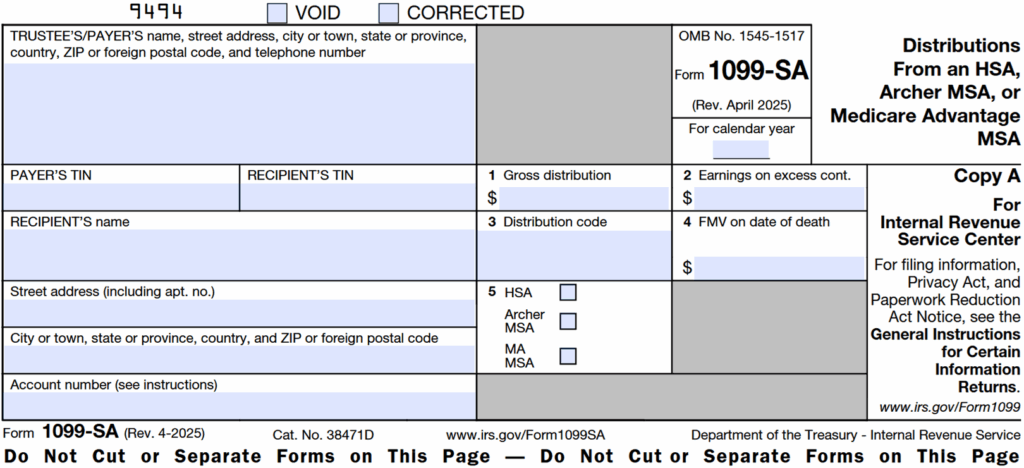

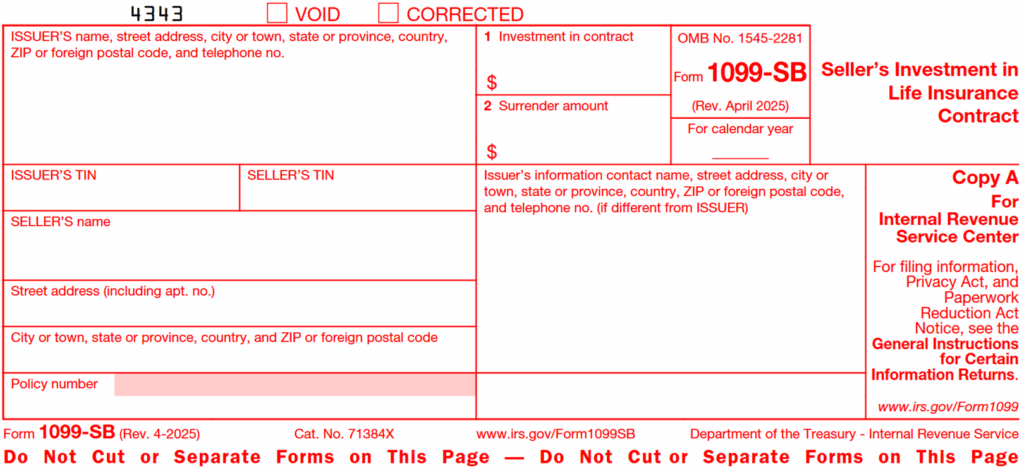

- 1099-A, 1099-B, 1099-C, 1099-CAP, 1099-DIV, 1099-G, 1099-H, 1099-INT, 1099-K, 1099-LS, 1099-LTC, 1099-MISC, 1099-NEC, 1099-OID, 1099-PATR, 1099-Q, 1099-QA, 1099-R, 1099-S, 1099-SA, 1099-SB

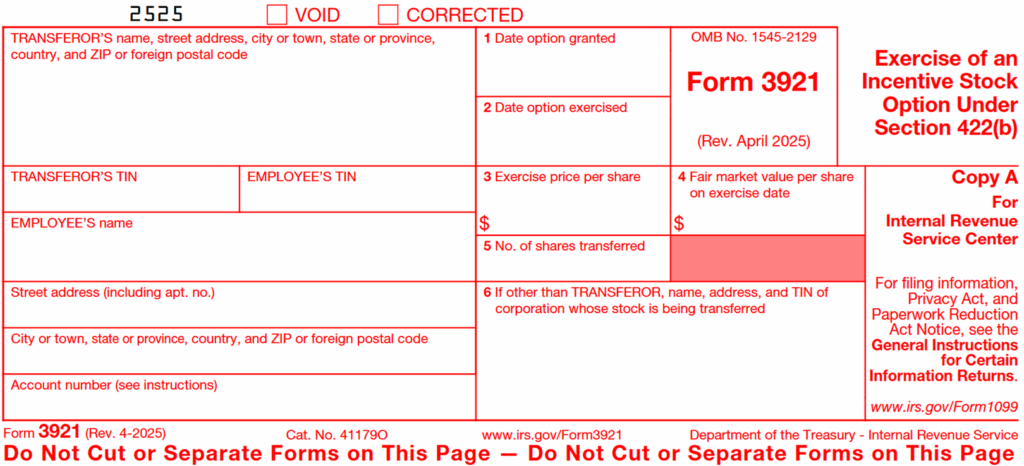

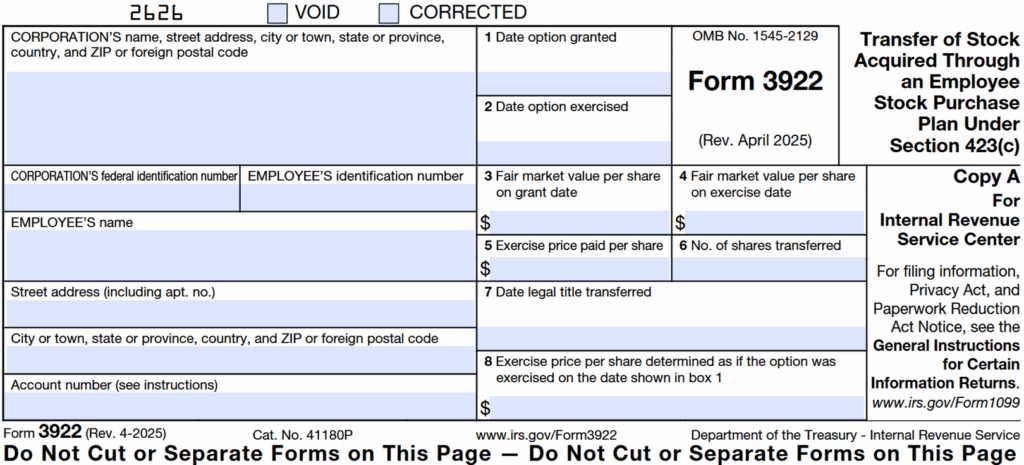

- 3921, 3922

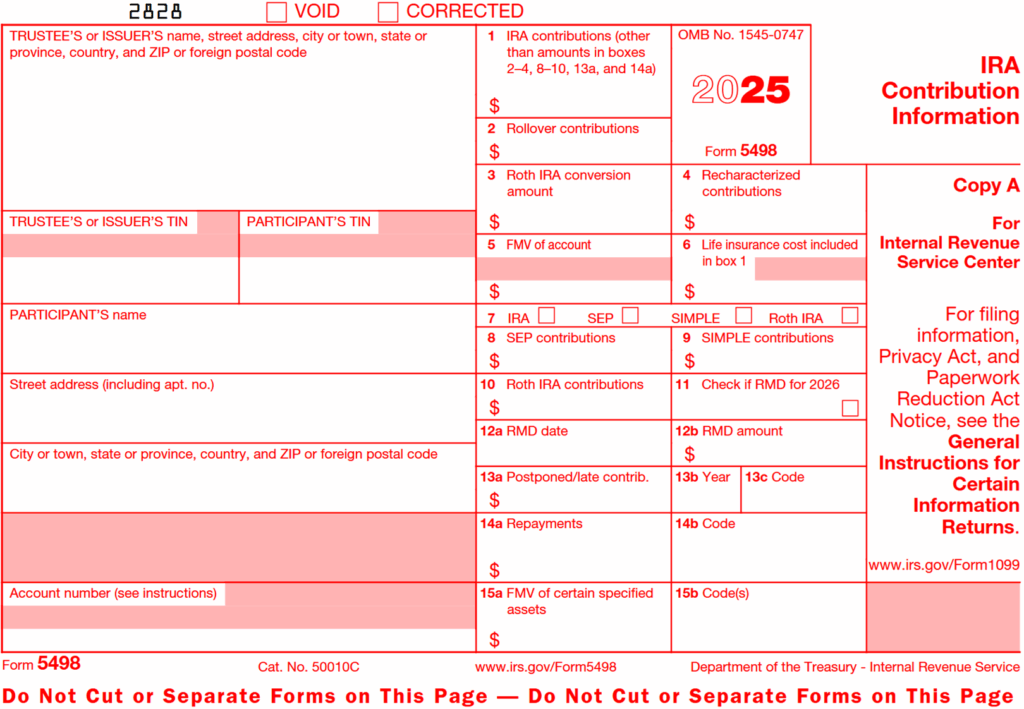

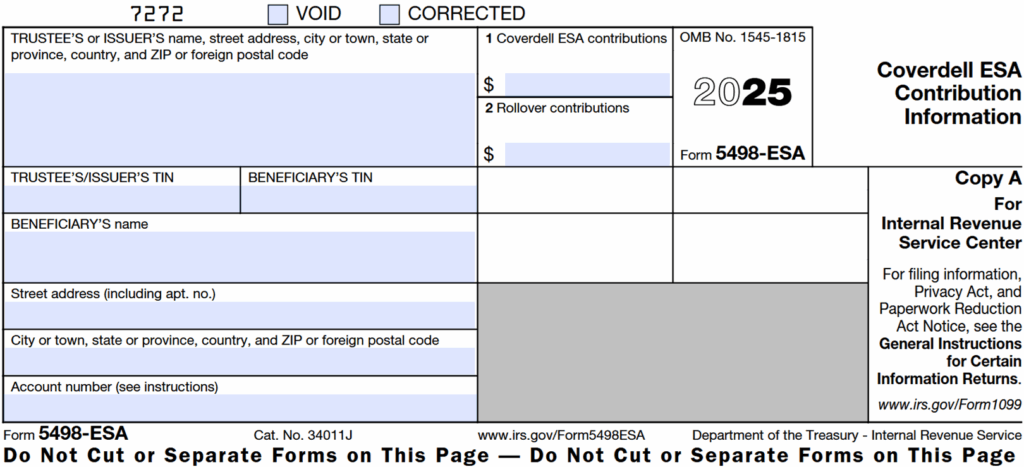

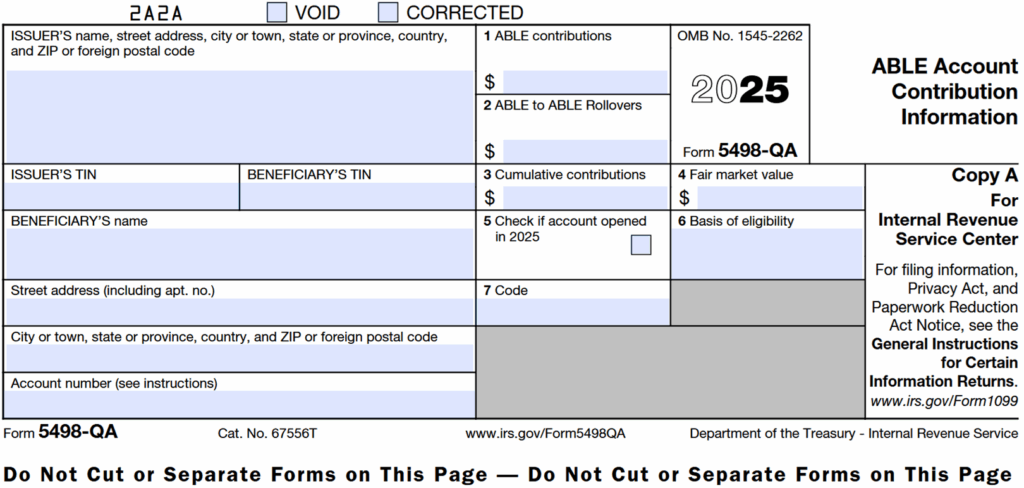

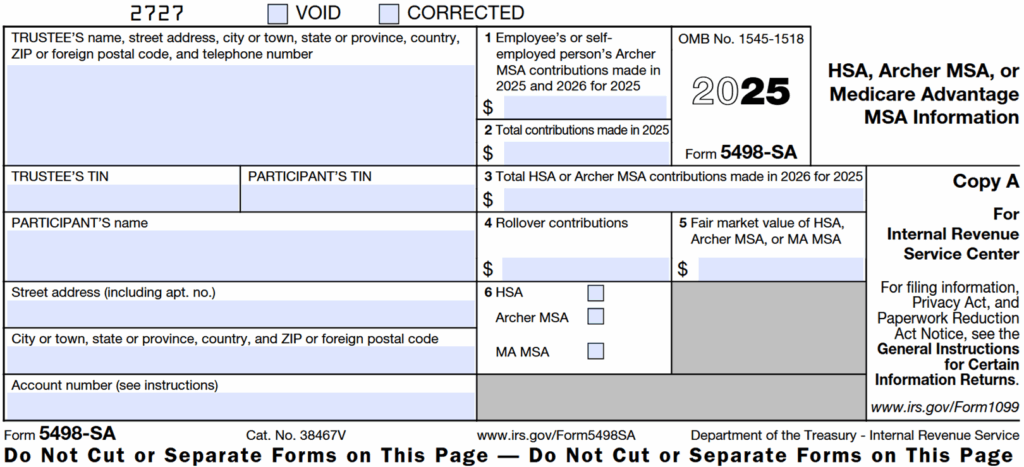

- 5498, 5498-ESA, 5498-QA, 5498-SA

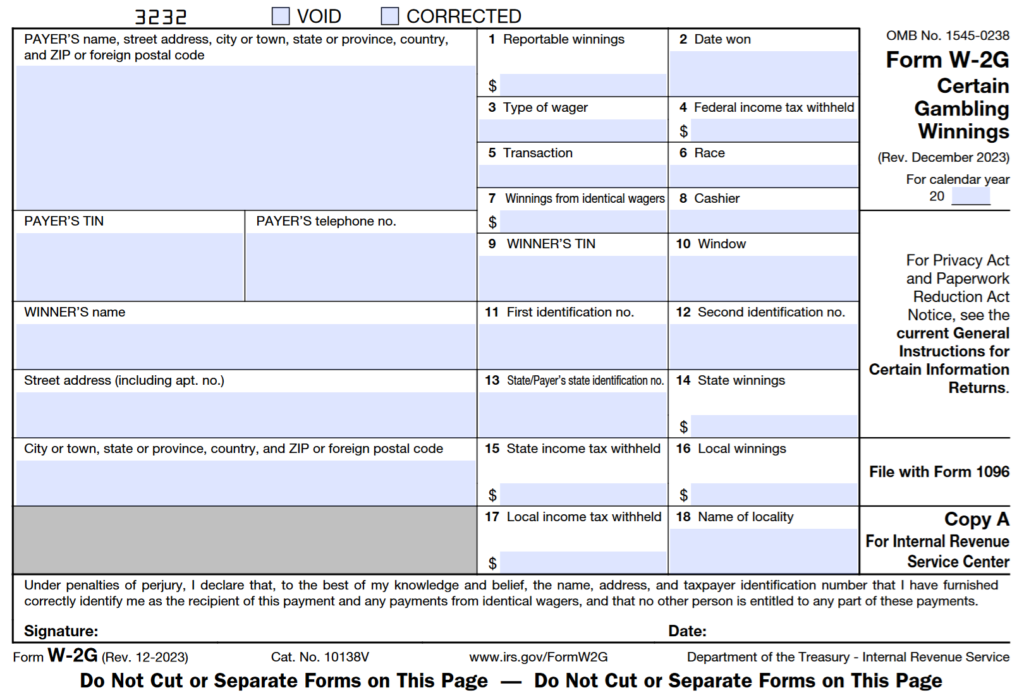

- W-2G

* Support for Forms 1042, 1042-S and 1042-T requires purchase of the Form 1042-S Premium Option. Please see the Premium Options tab for more information regarding available premium options.

Intuitive Navigation

The system features an intuitive, tabbed interface that makes it easy to navigate between core functions. Some tabs include sub-tabs for more detailed tasks. Once an issuer is selected in the opening grid, all information throughout the system reflects that issuer, ensuring consistent and easy management.

Why Choose Our 1099 Software?

- Exceptional value: Our software is designed to deliver professional 1099 preparation and filing without limitations on form types or additional fees.

- Unlimited forms: No limits or extra charges based on the number of Issuers, Recipients, or Forms.

- Industry expertise: Developed by a trusted banking software vendor with decades of experience in 1099 electronic reporting since 1985.

- No restrictions: Supports multiple companies and unlimited forms, making it ideal for service bureaus and businesses with varied needs.

- Outstanding support: Receive professional assistance via phone, email, internet, and access to a comprehensive manual.

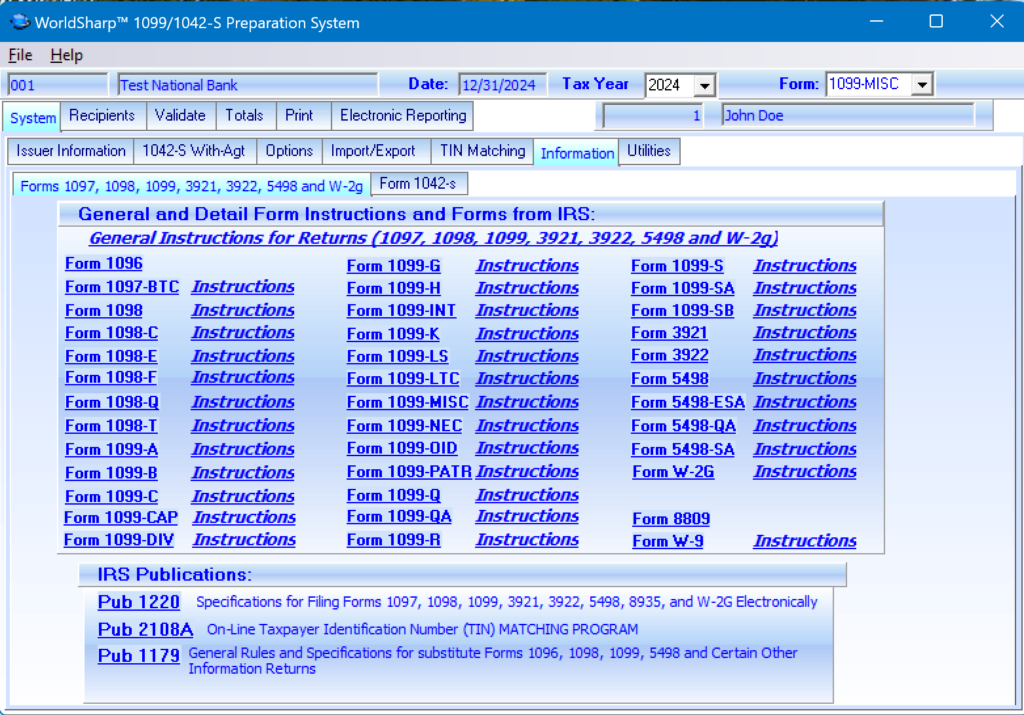

- Comprehensive IRS resources: Includes IRS forms, instructions, and publications, ensuring accurate and compliant reporting.

- Effortless data import: Easily import data from spreadsheets with provided sample templates, and receive help if needed.

- Professional printing: Print on pre-printed forms (with adjustable settings) or directly onto blank paper.

- Electronic filing: E-file all forms (1097, 1098, 1099, 3921, 3922, 5498, W-2G) for tax years 2000 to present, and file corrections at no extra charge.

- Electronic filing of Extensions: E-File IRS Extensions for forms allowed by IRS.

- Label printing: Generate labels on standard Avery laser forms for streamlined organization.

- TIN matching: Create files for the IRS Bulk TIN Matching program at no additional cost.

- Broad compatibility: Works on all Windows versions from Windows 7 to Windows 11 (32-bit and 64-bit).

Extensive Form Support

The WorldSharp 1099/1042-S Preparation System includes support for a notably broader range of IRS forms than most competitors, providing robust tax reporting capabilities within a single system. This wide-ranging support is designed to meet diverse filing needs. See the Supported Forms tab for details on the full list of supported forms.

No Extra Charge for Additional Form Types

The system supports a wide range of IRS forms under the standard price, with no added fees per form, aside from Form 1042, Form 1042-S and Form 1042-T, which are available as a premium option due to their unique filing requirements.

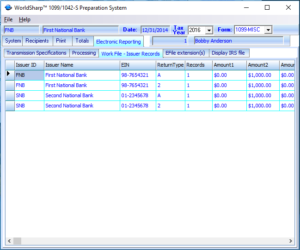

Unlimited Issuers and Recipients

The system supports unlimited issuers and recipients, allowing you to process as many as needed without any additional cost for volume. Issuers are managed in the Issuer Information tab, where you can assign a friendly Issuer ID for easy identification. While different forms can be associated with the same issuer record, you can also create separate issuer records for each form type to improve organization.

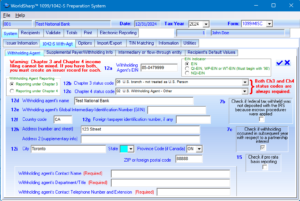

Specialized 1042-S Entry Screens

The system includes dedicated screens for entering Withholding Agent information and other details unique to 1042-S forms, including fields for intermediary or flow-through entities. Users can also set default information for recipients to streamline data entry when fields are identical across multiple recipients.

Note: Support for Forms 1042, 1042-S and 1042-T requires purchase of the Form 1042-S Premium Option. Please see the Premium Options tab for more information regarding available premium options.

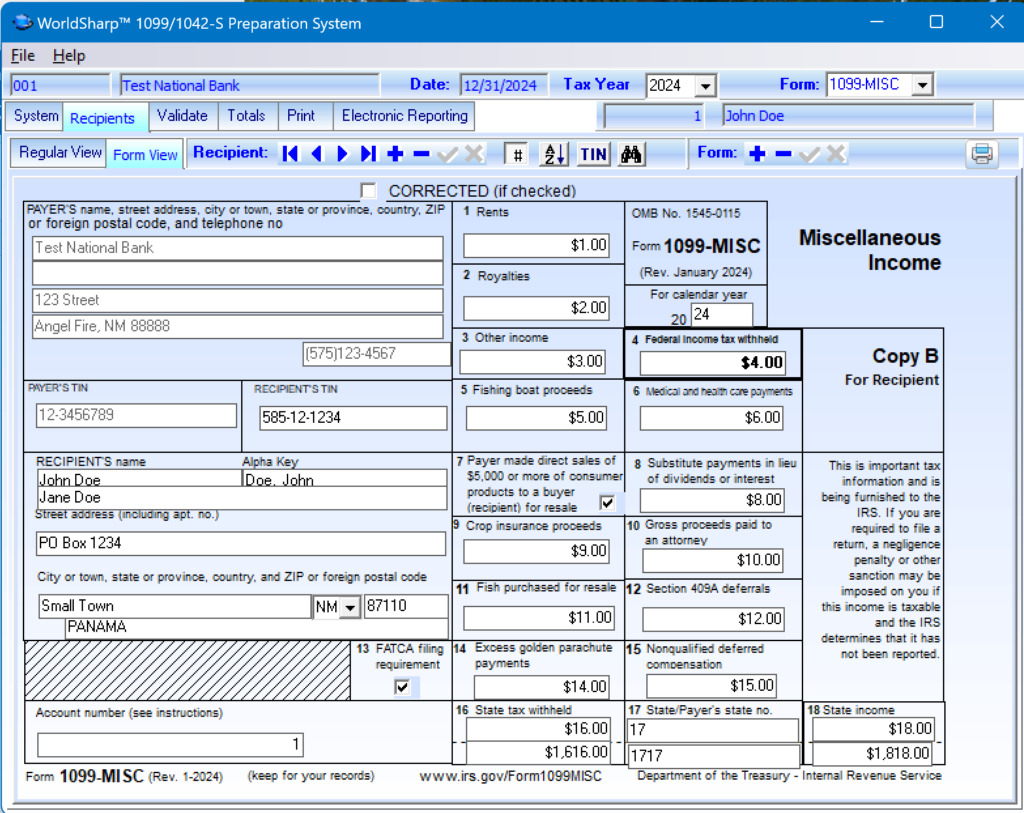

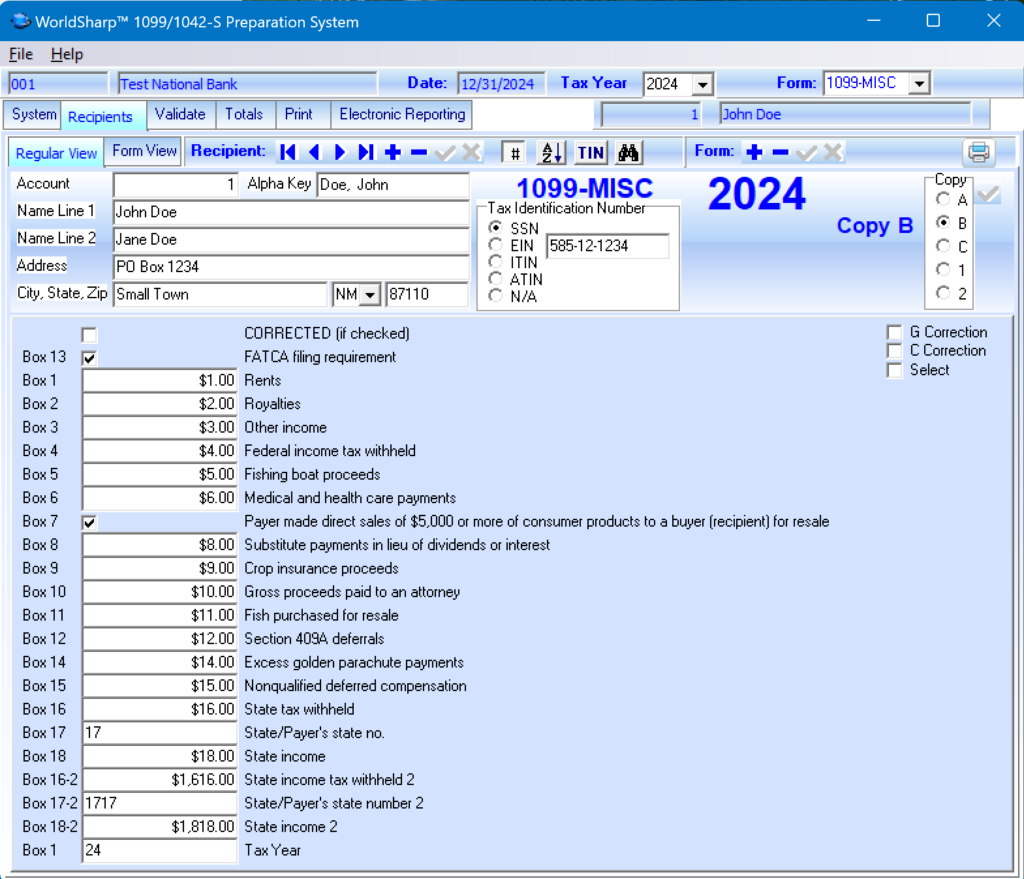

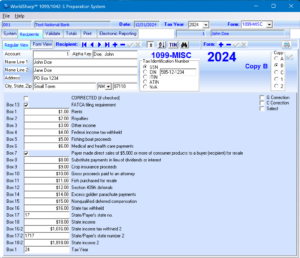

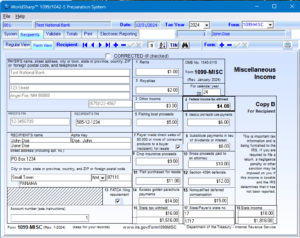

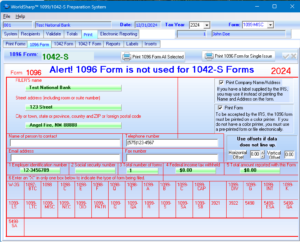

Form View Data Entry

The system simplifies data entry by tailoring the input screens to match each specific 1099 tax form. All required fields for both printing and electronic reporting are available once the form type is selected. The system offers two methods for entering data: rapid entry and form view entry. In form view entry, fields are displayed on the screen exactly as they appear on the printed form, making it easy to input and review data.

Rapid View Data Entry

In rapid entry mode, the system displays fields in a column format, with each field labeled by its corresponding box number and description. Account information is presented at the top, while form information is displayed at the bottom. Accounts can be easily located or accessed by account number, alphabetically, or by Tax Identification Number, allowing for fast and efficient data entry.

Extensive Printing Capabilities and Options

The system supports printing on both plain paper and pre-printed forms, with options to adjust alignment based on vendor or printer variations. Users can select which “Copy” to print, set the printing sequence, and choose whether to print a single page with instructions or multiple forms on a page.

Standard labels for addressing envelopes and reports for tracking recipients can also be printed, offering flexibility in managing both form distribution and internal record-keeping.

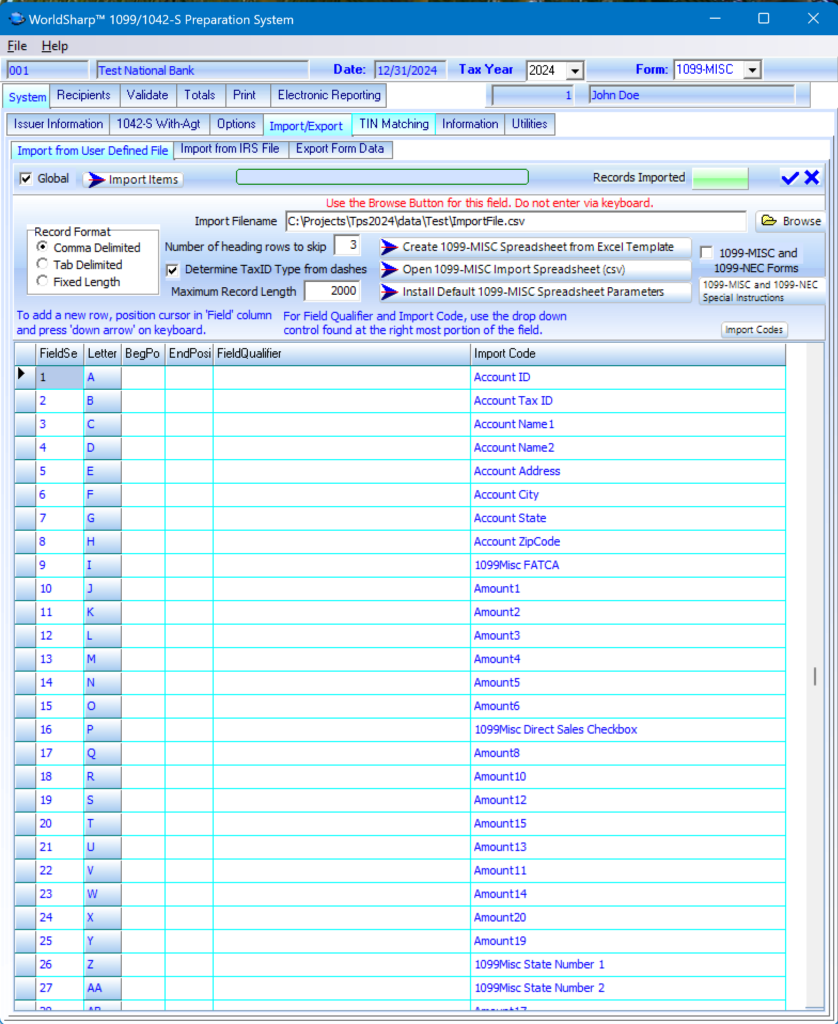

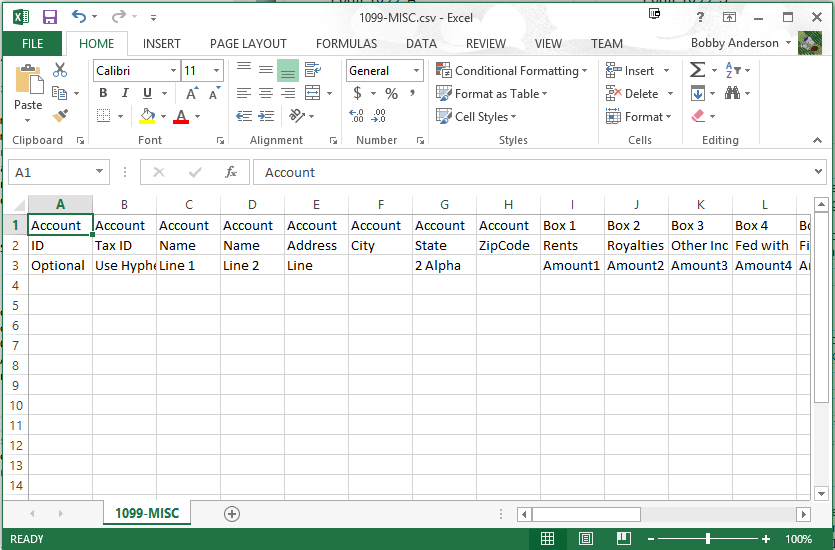

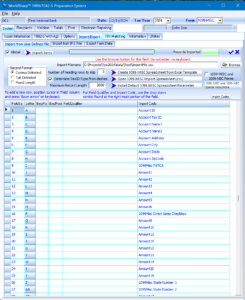

Import 1099 Data

The system’s ability to import 1099 data sets it apart from other solutions. Users can import data from spreadsheets or other files with ease. For spreadsheets, suggested templates are provided for each type of 1099 form, allowing automatic mapping when a template is used. For custom spreadsheets, the import process is straightforward—simply map the columns to be imported.

The system supports importing files in various formats, including comma-delimited, tab-delimited, and fixed-length records. Additionally, 1099 files in IRS format—whether from previous years or created by other software systems—can also be imported. While the import process is designed to be user-friendly, our dedicated support team is available to assist with any questions.

Spreadsheet Templates Provided for Import

The system offers spreadsheet templates for all supported 1099 forms, though their use is not required. When using the provided templates, the system automatically maps the relevant columns for import. If you are importing data from an existing spreadsheet, there’s no need to delete unused columns or rearrange them into a specific sequence—simply map the columns you wish to import, and the system handles the rest.

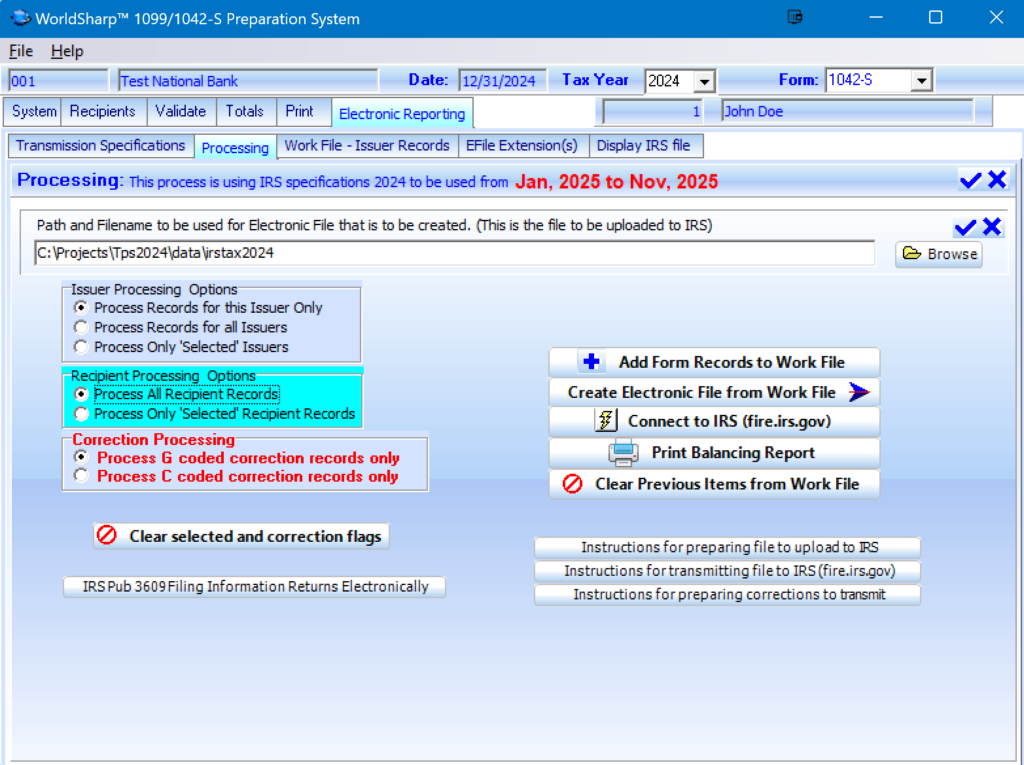

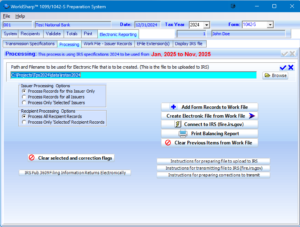

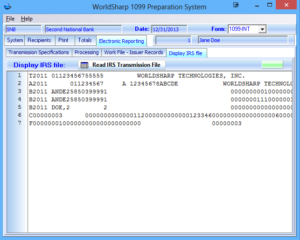

Electronic Filing (e-file)

The system makes it easy to prepare 1099 electronic transmission files in the IRS-required format. Updated annually to reflect any changes in IRS requirements, the system ensures a high acceptance rate. Should any files be rejected, WorldSharp will assist in analyzing and preparing replacement files. The system also supports electronic filing of corrections, and forms 4419 and 8809 can be printed if needed. E-filing is included with every system at no additional charge.

Process Corrections and Forms for 2000 to Present

The system allows processing of both forms and corrections for tax years 2000 to the present, though the IRS may update which years are accepted each year. Some of our customers use larger enterprise systems for their initial 1099 electronic reporting but rely on our system to print and file corrections, or handle form types not supported by their primary systems.

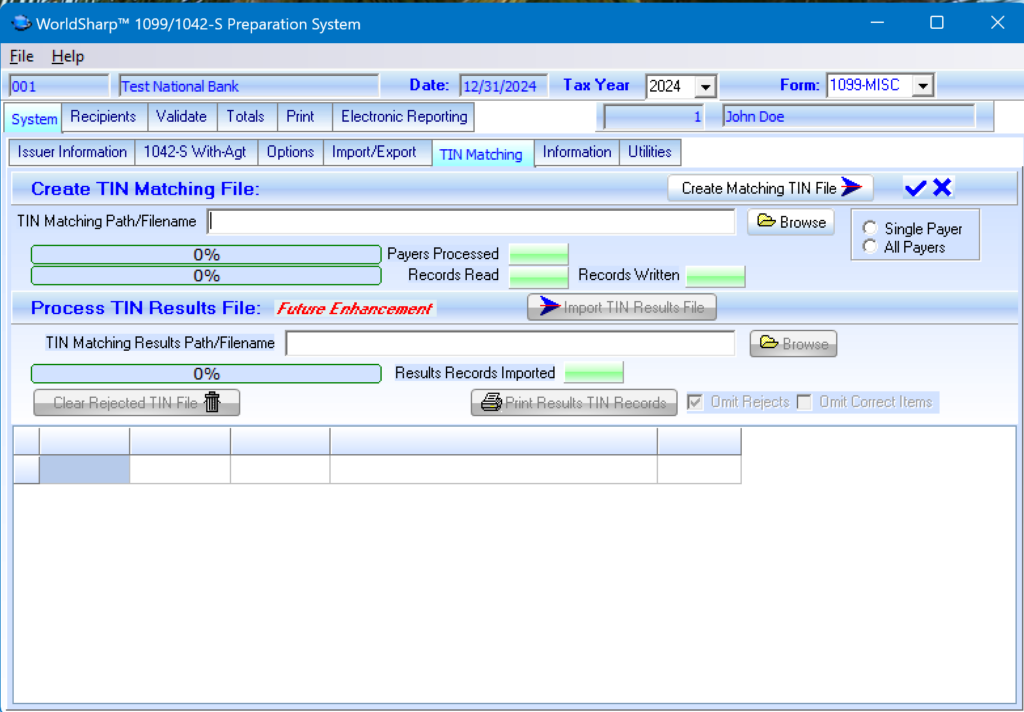

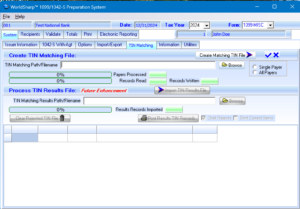

Creates File for TIN Matching Program

The system allows users to create a file for submission to the IRS Bulk On-Line Taxpayer Identification Number (TIN) Matching Program. This process helps verify TINs before filing, as outlined in IRS Publication 2108A, which is provided with the system. After submitting the file, the IRS will return a response indicating any incorrect TINs. This feature is included at no additional cost.

Support for Forms 1042-s and 1042-t

For customers needing to report income and withholding to foreign individuals and entities, our Support for Form 1042-S and Form 1042-T option can be added. This option activates specialized screens for entering information that only pertains to Form 1042-S, such as Withholding Agent details and data related to intermediary or flow-through entities.

In addition, this option supports the generation and printing of Form 1042-T if not filing electronically or for maintaining printed records. Adding this capability ensures compliance with the IRS requirements specific to foreign withholding and allows streamlined management of 1042 forms alongside your standard 1099 forms.

Finally, this option also supports entry and printing of Form 1042, both pages 1 and 2. The system does not currently support electronic filing of Form 1042.

Support for SQL Server

The WorldSharp 1099 Preparation System installs with SQL Server Compact, which offers two data management options. Users can maintain individual databases for independent work, or they may access a shared database to keep all data in one place. However, when using shared data, only one user may access the database at a time.

For teams needing concurrent access to shared data, the Support For SQL Server enables multiple users to work within the same database simultaneously. This feature requires a separate installation of Microsoft SQL Server.

Shipped CD

You can request that we ship you a physical CD containing the system. You will still have access to the download version of the software even if you order a physical CD. There is a flat charge for the CD. We do not add any additional shipping charges.

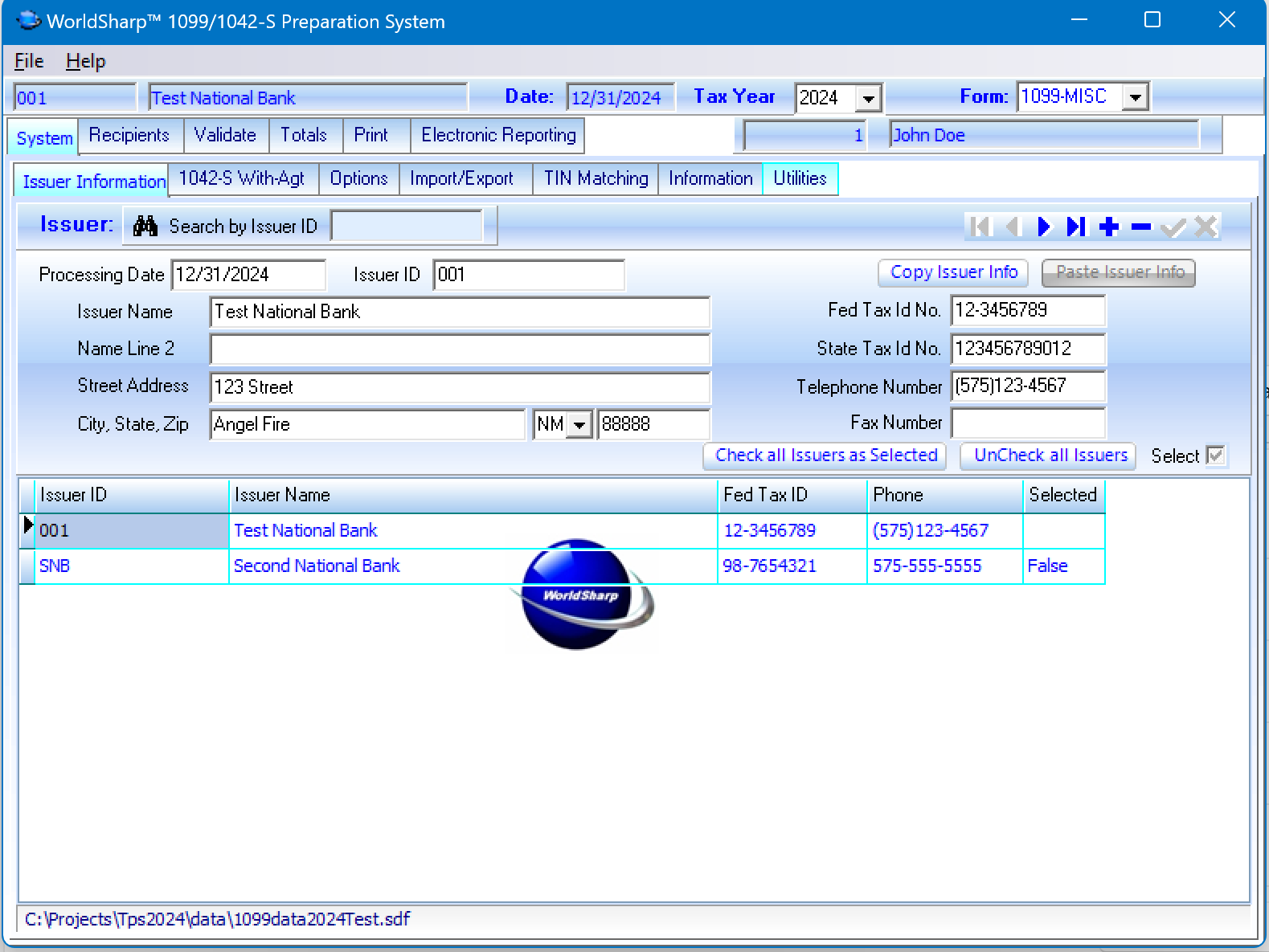

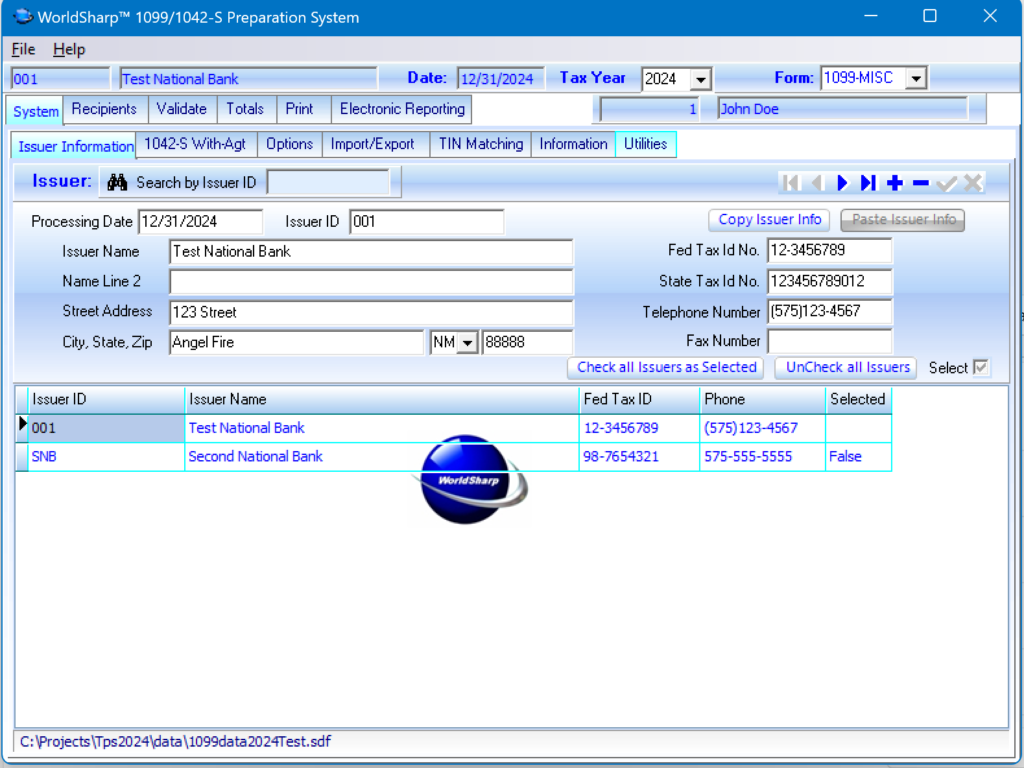

Main Screen – System/Issuer Information

The main screen of the WorldSharp 1099/1042-S Preparation System features a tabbed interface, with some tabs containing additional sub-tabs for deeper functionality. You can click the image to the left to enlarge the screen.

This screen is where issuer information is entered and managed. The grid displays a row for each issuer, and once an issuer is entered or selected, all other screens automatically update with the corresponding information. For a company, there may be only one issuer, while for a CPA firm, there could be many issuer records.

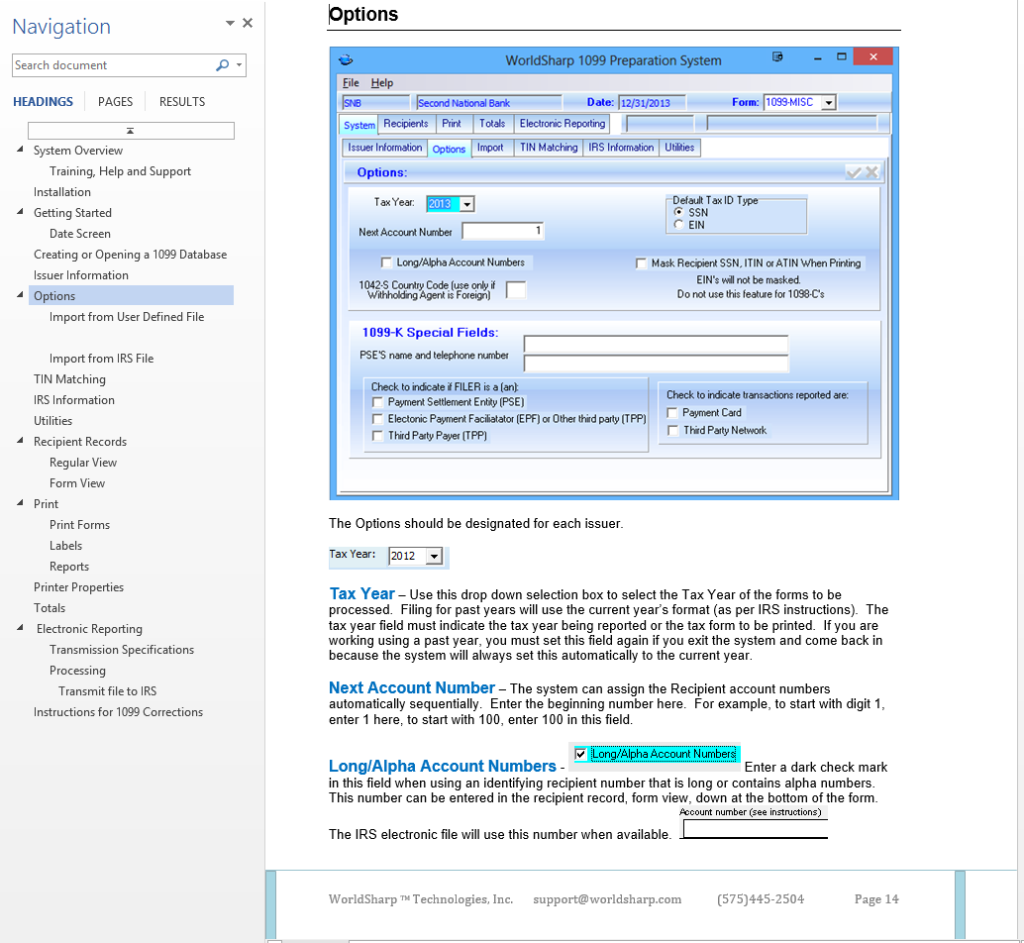

System Options

This screen allows users to set the Tax Year, which is generally only necessary when processing forms from previous years. Various processing options can also be configured here, such as whether to mask recipients’ Tax Identification Numbers.

Additionally, this screen includes special fields required for certain 1099 forms, such as the 1099-K.

Import

The Import screen is where users configure parameters for importing form data from spreadsheets or comma-delimited files. Templates are provided for each type of 1099 form, but they are not required. If the templates are used, the system automatically maps the spreadsheet columns to the appropriate fields.

Additionally, the Import Codes button opens a PDF that lists all the codes required for each data field that can be imported.

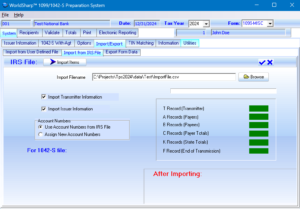

Import from IRS File

This screen allows users to import information from a file formatted for IRS transmission. There are several scenarios where this feature is useful:

- Importing a file from another system to process corrections on some or all records.

- Combining forms from a file created by another program with additional forms.

- Importing a file created by a service bureau or another company that needs to be filed with different transmitter information.

- Reusing a file from a previous year, where most names and addresses remain the same.

TIN Matching

This screen allows users to create files in the format required for the IRS TIN Matching Program. Certain payers may need to participate in this program to verify Tax Identification Numbers. Details about the program and participation requirements can be found in IRS Publication 2108A, which is provided with the system.

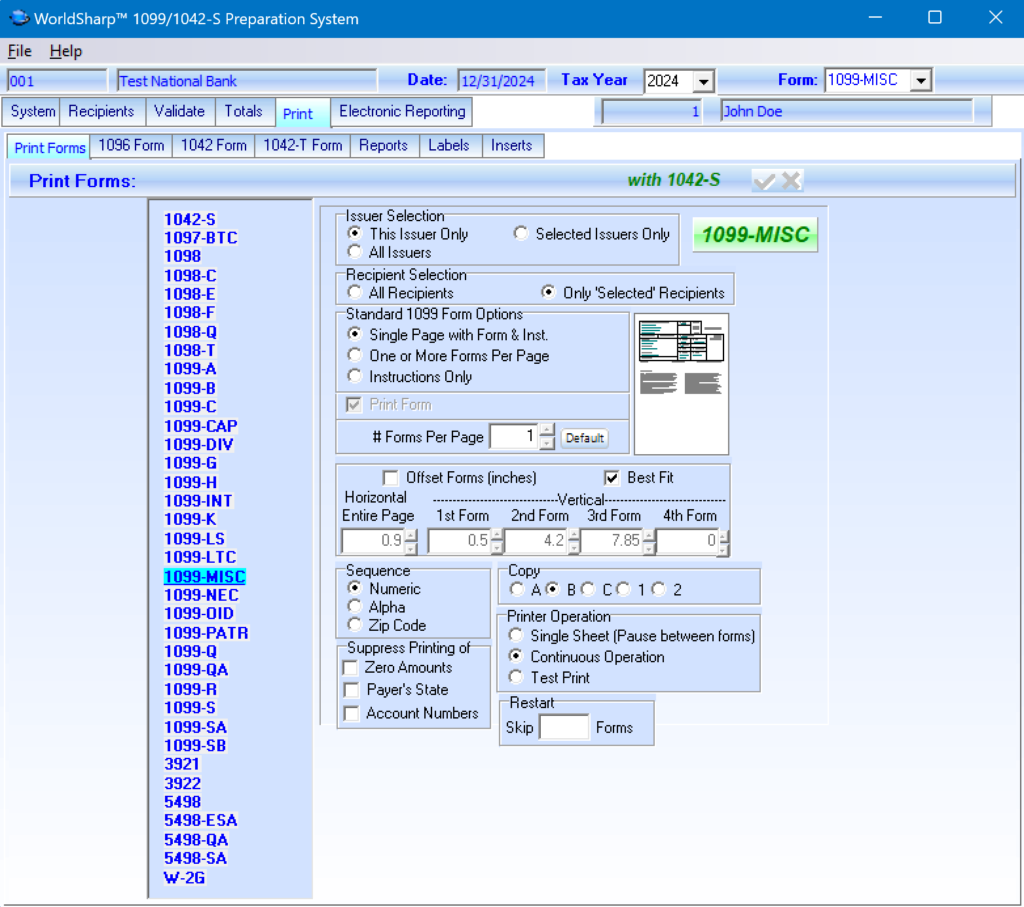

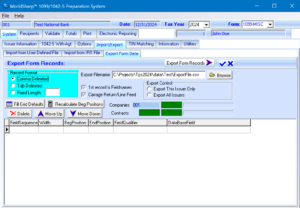

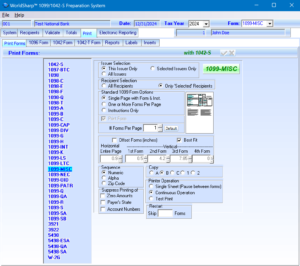

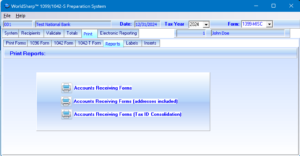

Print Forms

In this screen, when a form type is selected on the left, the parameters on the right will adjust for that specific form and will be saved for future print jobs. These parameters allow you to specify options such as whether to print for the current issuer only or for all issuers, and which copy of the form to print.

Additional options include form alignment, particularly useful when printing on pre-printed forms, which can vary by vendor or printer.

If no changes are made to the parameters, the default setting will print on plain paper for the current issuer, with Copy B at the top and instructions printed below.

Print Labels

Labels can be printed on standard Avery laser or inkjet paper stock, with options to adjust the top margin and height. An additional message, such as “Important Tax Return Document Enclosed,” can be printed at the bottom of the label.

A comma-delimited file can also be created, allowing the label information to be used for printing in other formats or imported into Microsoft Word for use in mail merge with letters or other documents.

Totals (Forms 1096/1042-T)

This screen allows users to view or print total amounts for Form 1042-S on a Form 1042-T. The 1042-T form can be printed on plain or pre-printed paper.

If processing 1099 forms, this screen also provides totals and printing options for Form 1096.

Note: Support for Form 1042-S and Form 1042-T requires purchase of the Form 1042-S Premium Option.

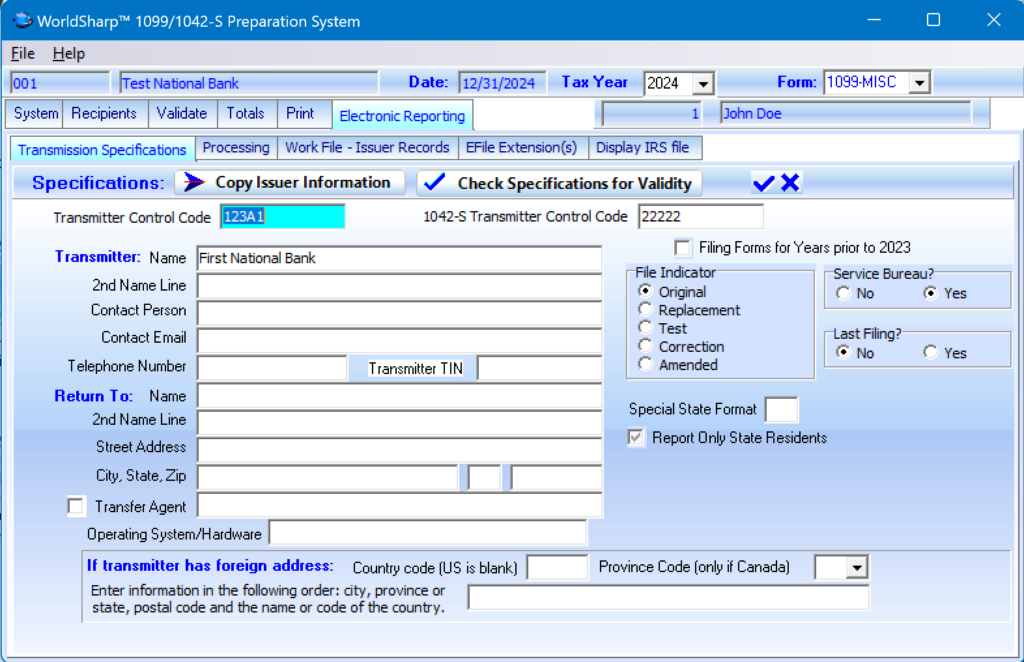

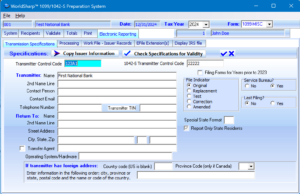

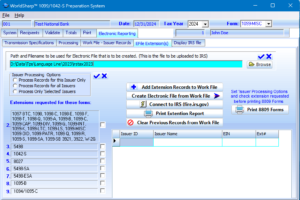

Electronic Reporting/Transmission Specifications

This screen is used to enter the Transmitter Control Code and other required transmitter information and options.

If the transmitter does not have a Transmitter Control Code, Form 4419 must be mailed or faxed to the IRS. This form is provided with the system.

Electronic Reporting Extensions

The Electronic Reporting Extensions screen allows users to apply for additional time to file their forms with the IRS for the various forms for which the IRS allows extensions. This feature is especially useful when processing high volumes or handling unforeseen delays in preparation.

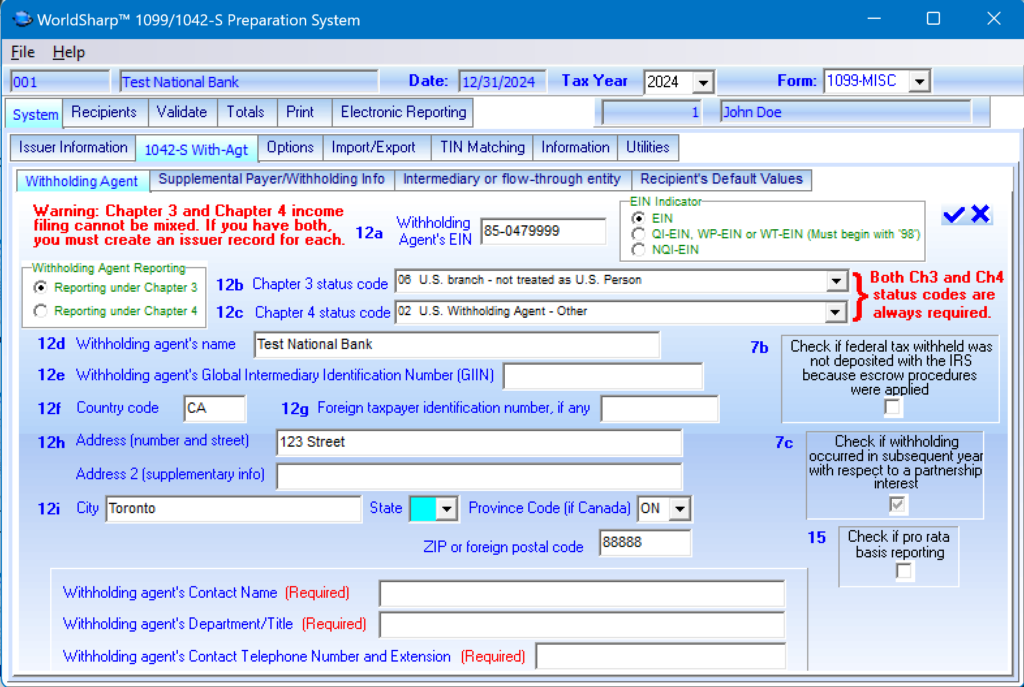

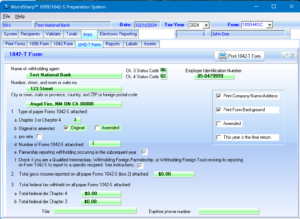

1042-S Withholding Agent Information

This screen allows users to enter information for the withholding agent. Dropdown menus are provided to simplify selection of the appropriate status codes.

Note: Support for Forms 1042, 1042-S and 1042-T requires purchase of the Form 1042-S Premium Option.

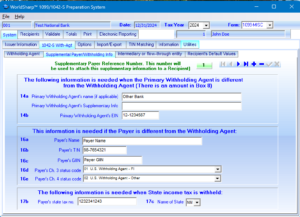

1042-S Payer and Withholding Agent Supplemental Information

This screen allows users to enter supplemental details if the Payer differs from the Withholding Agent. It also includes fields for entering required information when state income tax is withheld. In cases where the Primary Withholding Agent is different from the Withholding Agent, this screen captures those specifics as well.

Note: Support for Forms 1042, 1042-S and 1042-T requires purchase of the Form 1042-S Premium Option.

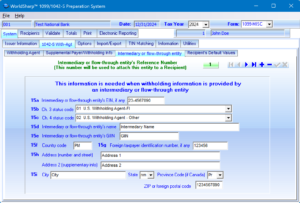

1042-S Intermediary or Flow-Through Entity Information

This screen provides fields for entering information related to intermediary or flow-through entities. Dropdown menus are available to help users easily select the correct status codes for these entities.

Note: Support for Forms 1042, 1042-S and 1042-T requires purchase of the Form 1042-S Premium Option.

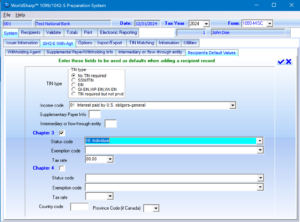

1042-S Default Recipient Values

This screen enables users to set default values for recipients when many or all recipients share the same information for specific fields or codes.

Note: Support for Forms 1042, 1042-S and 1042-T requires purchase of the Form 1042-S Premium Option.

1042-S Recipients Regular View

The 1042-S Recipients Regular View provides a straightforward interface for entering or viewing recipient details. Users can quickly locate or add accounts, then proceed to enter or update form information as needed. This view is optimized for rapid data entry and is especially helpful when processing multiple recipients with similar data.

Note: Support for Forms 1042, 1042-S and 1042-T requires purchase of the Form 1042-S Premium Option. .

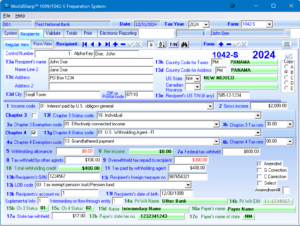

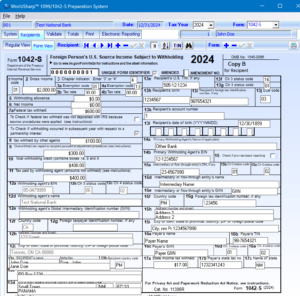

1042-S Recipients Form View

The 1042-S Recipients Form View displays information in the format of the 1042-S form itself, making it ideal for thorough review and precise data entry. Each required field appears as it would on the printed form, allowing users to confirm the accuracy of information. This screen also allows printing of the current form for immediate access.

Note: Support for Forms 1042, 1042-S and 1042-T requires purchase of the Form 1042-S Premium Option.

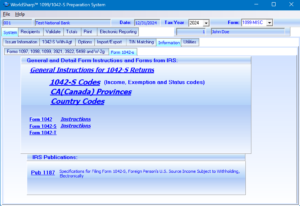

1042-S IRS Information

This screen provides users with direct access to IRS instructions, codes, and publications relevant to Form 1042-S, all available in one place for reference. It simplifies compliance by offering easy access to the latest information and resources, ensuring users have what they need to complete Form 1042-S accurately.

Note: Support for Forms 1042, 1042-S and 1042-T requires purchase of the Form 1042-S Premium Option.

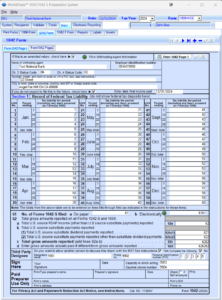

Print 1042-T

This screen is used for printing Form 1042-T, which summarizes the totals for multiple Forms 1042-S being filed. Users can choose to print on plain or pre-printed paper based on their needs. The screen will update automatically to display totals relevant to the selected issuer. This form is only required when paper filing. Some issuers who efile will still print this form for their own records.

Note: Support for Forms 1042, 1042-S and 1042-T requires purchase of the Form 1042-S Premium Option.

Print 1042

The Print 1042 screen provides options for printing Form 1042, both pages 1 and 2, used by withholding agents to report U.S. income paid to foreign persons. Users can print on plain paper. This screen ensures that all relevant withholding and income details are accurately reflected for filing. Note: The system currently does not support electronic filing of Form 1042, only printing, which can be used for paper filing. The IRS requires this form to be electronically filed, however, the deadline for this requirement has been delayed, therefore allowing paper filing for 2024.

Note: Support for Forms 1042, 1042-S and 1042-T requires purchase of the Form 1042-S Premium Option.

Click a form to scroll directly to the form:

* Support for Forms 1042, 1042-S and 1042-T requires purchase of the Form 1042-S Premium Option.

Hardware Requirements

- Memory: 4GB or more recommended

- Disk Space: 100 MB for installation and basic data storage, with additional space required for larger datasets

Software Requirements

- Operating System: Windows 7, 8.1, 10, 11, and all Windows Server versions, both 32-bit and 64-bit

- PDF Reader: Adobe Acrobat or any compatible PDF reader to view certain instructions or IRS documentation

- Word Processor: Microsoft Word or compatible software for accessing the instruction manual

- Microsoft .NET Framework: Version 4.0 or later (the system will prompt you to install it if it’s not already installed)

- Database:

- By default the WorldSharp 1099/1042-S Preparation System requires and installs SQL Server Compact along with Mcrosoft .NET framework,, which offers two data management options. Users can maintain individual databases for independent work, or they may access a shared database to keep all data in one place. However, when using shared data, only one user may access the database at a time.

- For users who purchase the SQL Server option, Microsoft SQL Server 2017 or later is required.

Multi-System and Multi-User Configurations

For information on using the system across multiple users or clients, including concurrent database access options, please see the SQL Server Support option on the Premium Options tab.