The WorldSharp W-2 Preparation System streamlines the creation, printing, and filing of essential tax forms, supporting Forms W-2, W-2c, W-3, and W-3c. Designed for ease of use and efficiency, the system offers robust data import capabilities, flexible printing options, and the ability to generate e-file-ready files for submission to the Social Security Administration (SSA).

Supported Forms

The system supports Forms W-2, W-2c, W-3, and W-3c. It eliminates the need for preprinted forms by allowing users to print Copy A and other form types directly on plain paper, which can be paper-filed with the SSA.

Easy Navigation

The intuitive interface features a tabbed layout for quick access to key functions. Once an employer is selected on the main screen, all subsequent tabs display data specific to that employer, simplifying the process and improving workflow.

Key Features

- Comprehensive Form Support: Prepare and print all required forms for employee wage and tax reporting, including corrections.

- Flexible Printing Options: Print data on preprinted forms or generate forms entirely on blank paper, including standard-size or compact layouts (four-per-page horizontal or cornered).

- Generate SSA-Ready E-File Files: Create SSA-compliant files for electronic filing. These files can be easily uploaded to the SSA’s Business Services Online (BSO) portal for submission, ensuring an efficient and accurate filing process.

- Unlimited Employers and Employees: Manage records for as many employers and employees as needed without restrictions.

- TIN Matching Integration: Includes tools to create files for the SSA’s Bulk TIN Matching Program at no additional cost, ensuring compliance and accuracy.

- Professional Support: Receive expert assistance via phone, email, and detailed system documentation.

Whether you manage a single business or multiple employers, the WorldSharp W-2 Preparation System offers the tools you need to simplify tax reporting while maintaining compliance with SSA requirements.

Comprehensive Form Support

The WorldSharp W-2 Preparation System supports all essential W-2-related forms, including W-2, W-2c, W-3, and W-3c. Whether filing original forms or corrections, our system ensures accuracy and compliance with Social Security Administration (SSA) requirements.

Flexible Printing Options

Print forms directly on preprinted templates or generate fully compliant forms on blank paper. Choose from various layouts, including regular IRS-sized forms, four forms per page (horizontal), or four forms positioned in each corner of the page. Forms can also be saved as PDFs for digital record-keeping.

Robust Data Import Capabilities

Simplify data migration and updates with the system’s versatile import functionality. Import W-2 information from spreadsheets (CSV files) using either the provided template or your custom file, with support for comma-delimited, tab-delimited, or fixed-length formats.

Additionally, the system allows you to import W-2 files directly from the Social Security Administration (SSA), making it easy to process corrections or re-use data from prior filings.

Bulk TIN Matching Support

Create files for submission to the SSA’s Bulk Taxpayer Identification Number (TIN) Matching Program. This feature helps verify TINs before filing, ensuring compliance and accuracy.

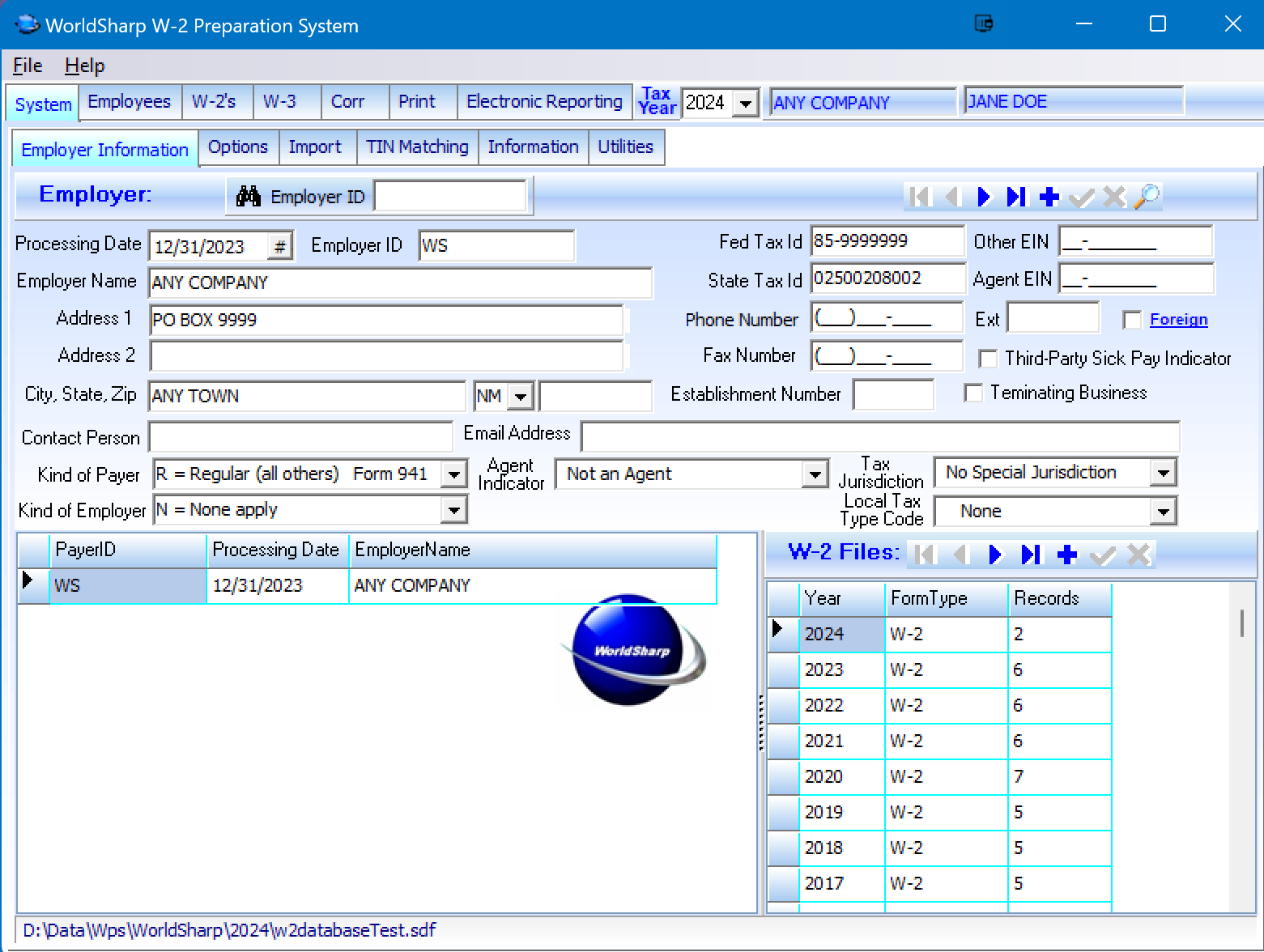

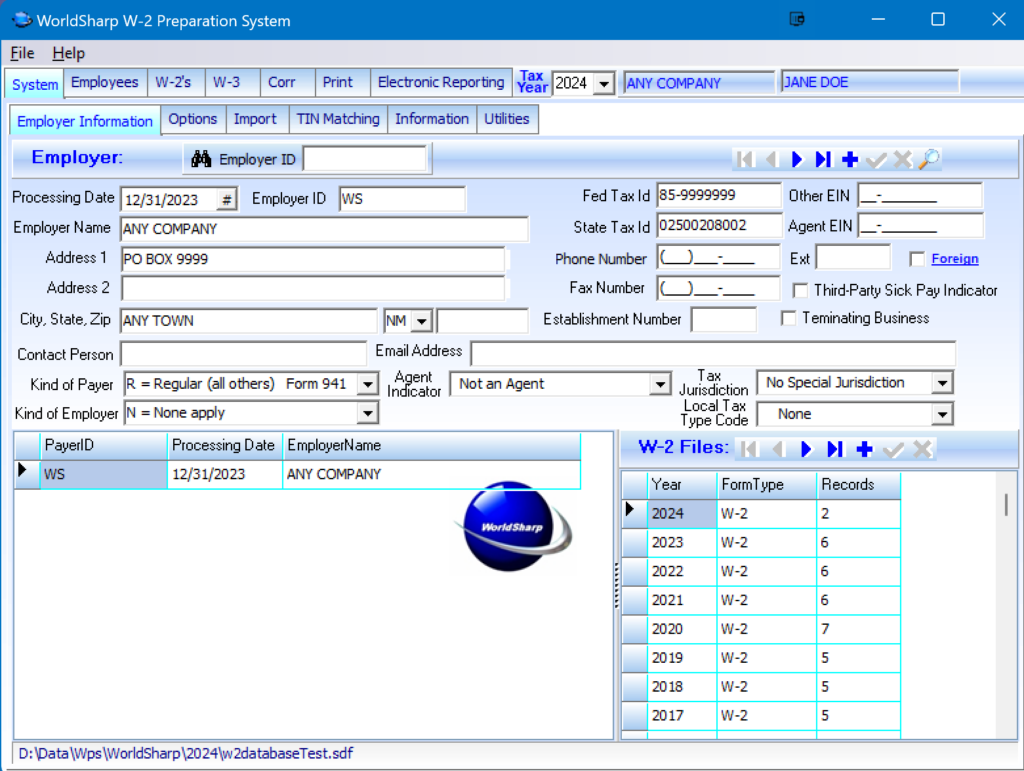

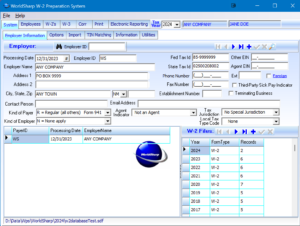

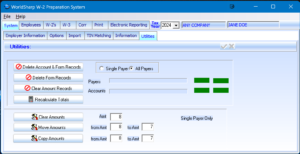

Main Screen – Employer Information

The main screen of the WorldSharp W-2 Preparation System features a tabbed interface, with additional sub-tabs in certain sections.

This screen is used to enter and manage employer information. Each employer appears as a row in the grid, and once an employer is entered or selected, all other screens and tabs automatically display data relevant to that employer. For single companies, there may be only one employer record, while CPA firms or payroll providers may manage multiple employers within the system.

This screen also allows users to set the Tax Year. While this is typically set to the current year, it can be adjusted to process or print forms from prior years when needed.

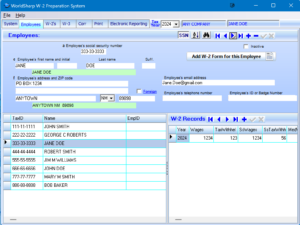

Employees Display/Entry

This screen allows users to enter and manage employee records with all the fields required for generating W-2 forms. Employee records can be sorted and accessed by Social Security Number (SSN) or alphabetically. Additional fields, such as email address, phone number, and Employee ID or badge number, are included to help streamline the management process. The system also supports the entry of foreign addresses when applicable.

A button is provided to add a W-2 form for the selected employee.

On the left, a grid displays a list of all employees for the selected employer, while a second grid shows all W-2 forms currently on file for the selected employee. Clicking on a W-2 in the list navigates directly to the details of that form for further review or editing.

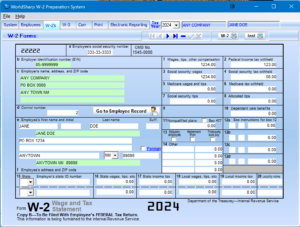

W-2 Display/Entry

This screen allows users to add and edit W-2 forms. When a W-2 is added from the employee screen, it automatically includes the employer and employee information. Users can then enter the required amount fields, which are displayed in locations that closely match the layout of the official IRS W-2 form.

Navigation tools are available to move between W-2s for the selected employer. Additionally, buttons are provided to print a single W-2 form and its associated instruction sheet.

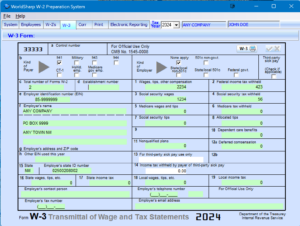

W-3 Display/Entry

This screen simplifies the preparation of W-3 forms by automatically calculating and entering most required fields based on the associated W-2 forms. Users only need to manually input a few additional fields if they apply to the W-3.

A dedicated button is available to print the W-3 form, ensuring easy access to a finalized copy.

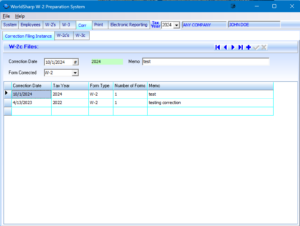

Correction Filing Instance

The Correction Filing Instance screen allows users to create and manage sets of corrections. Each correction instance acts as a container for one or more corrections related to a specific employer or filing period. Once an instance is created and saved, the operator can proceed to the next tab to input the specific correction details.

This setup ensures a clear organization of correction entries, making it easier to track and manage multiple updates.

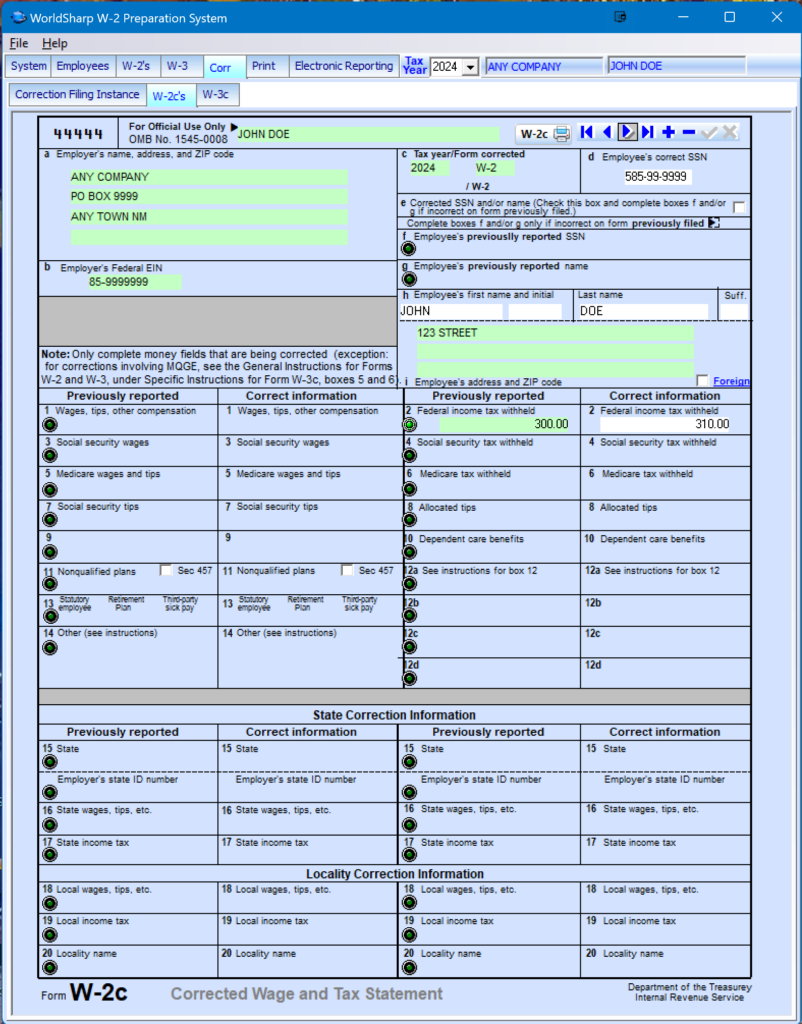

W-2c Display/Entry

The W-2c form is used to make corrections to W-2 forms already provided to employees. To initiate corrections, locate the W-2 requiring updates in the W-2 Screen. Once selected, press the ‘+’ button on the navigation bar within the W-2c screen to access the W-2’s existing information.

To correct a field, click the green LED in the corresponding box. The original value will display on the left, allowing you to enter the corrected amount on the right. This ensures clear tracking of changes.

A dedicated button allows you to print the finalized W-2c form for your records or distribution.

W-3c Display/Entry

This screen is used to prepare corrections for the W-3 form after W-2c forms have been entered. The system automatically calculates and populates the required fields on the W-3c form based on the entered corrections.

For non-monetary fields requiring updates, users can activate the correction mode by pressing the green LED in the corresponding box. This enables the entry of updated information directly into the field.

A print button is available to generate the W-3c form for filing or record-keeping purposes.

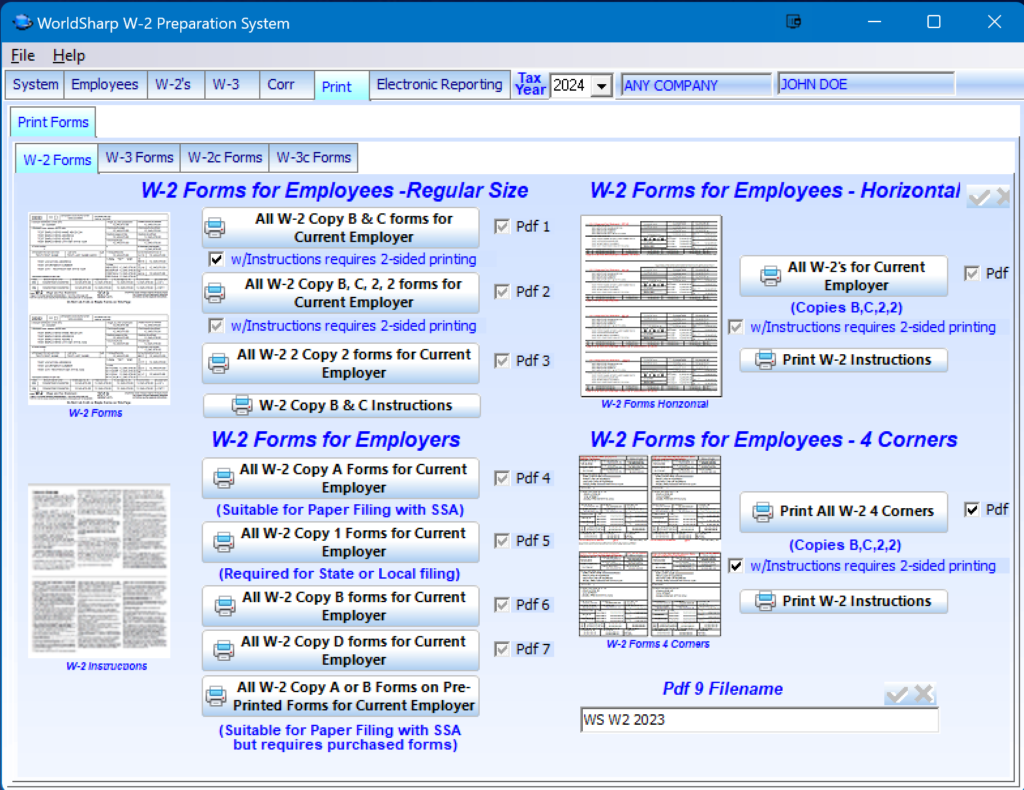

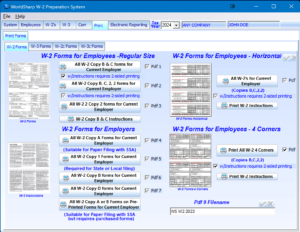

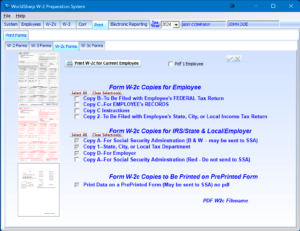

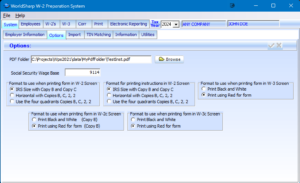

Print W-2 Forms

The system offers a variety of formats for printing W-2 forms to meet different filing and distribution needs. The standard IRS size (half-page format) can be printed in several ways, including:

- Printing Copy B on the top and Copy C on the bottom of a single page, with an option to include instructions on the back (requires a duplex printer).

- 4 Horizontal Forms per Page: Copies B, C, 2, and 2 arranged in a single horizontal row.

- 4 Corner Forms per Page: Copies B, C, 2, and 2 arranged in each corner of the page.

- Directly onto pre-printed forms.

The system also supports generating a PDF file for digital distribution or archival purposes.

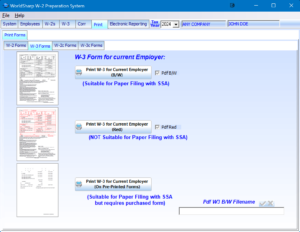

Print W-3

The system provides multiple options for printing W-3 forms to suit various preferences and requirements. Forms can be printed:

- In black and white or red ink to match official formatting.

- Directly onto pre-printed forms.

The system also supports generating a PDF file for digital distribution or archival purposes.

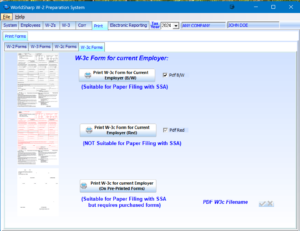

Print W-2c Forms

The system offers versatile printing options for W-2c forms to meet various reporting needs. Forms can be printed:

- In black and white or red ink to match official formatting.

- Directly onto pre-printed forms.

The system also supports generating a PDF file for digital distribution or archival purposes.

Print W-3c Forms

The system offers flexible printing options for W-3c forms to accommodate various reporting requirements. Forms can be printed:

- In black and white or red ink to match official formatting.

- Directly onto pre-printed forms.

The system also supports generating a PDF file for digital distribution or archival purposes.

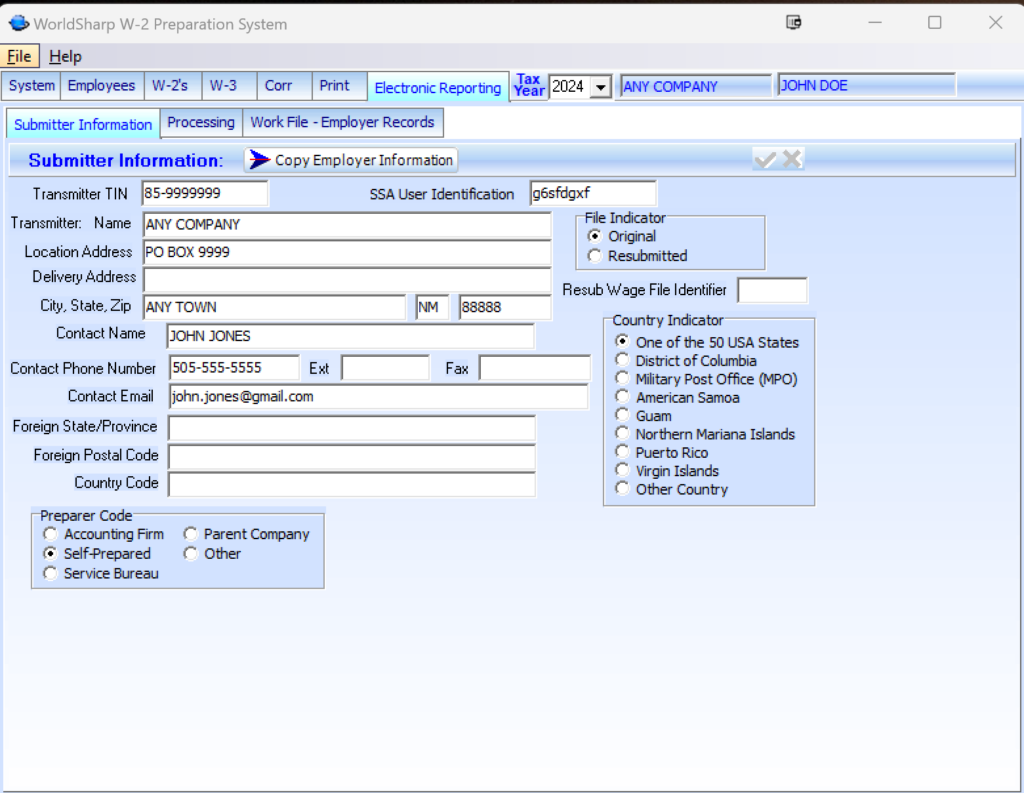

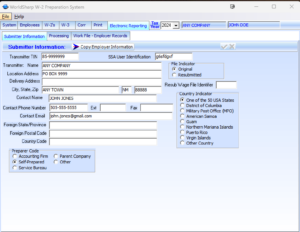

Electronic Reporting Section (Submitter Information)

The system simplifies the creation of files suitable for submission to the Social Security Administration. If the submitter is the same as the employer, a dedicated button automatically copies the employer details into the submitter screen, saving time and reducing errors.

Additional fields allow users to input or edit any remaining information required for accurate submission.

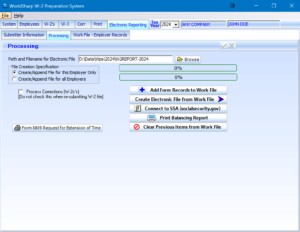

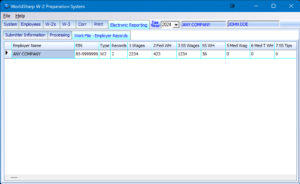

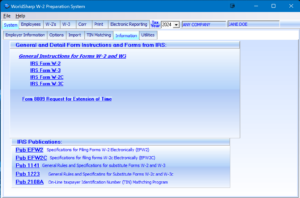

Electronic Reporting Section (Processing)

This screen facilitates the creation of files suitable for submission to the Social Security Administration. Operators can generate and prepare files in the required format and connect directly to the SSA for submission.

In addition to standard submissions, this screen also allows users to create correction files for previously submitted data. For convenience, a Form 8809 (Request for Extension of Time) can be generated and printed when needed.

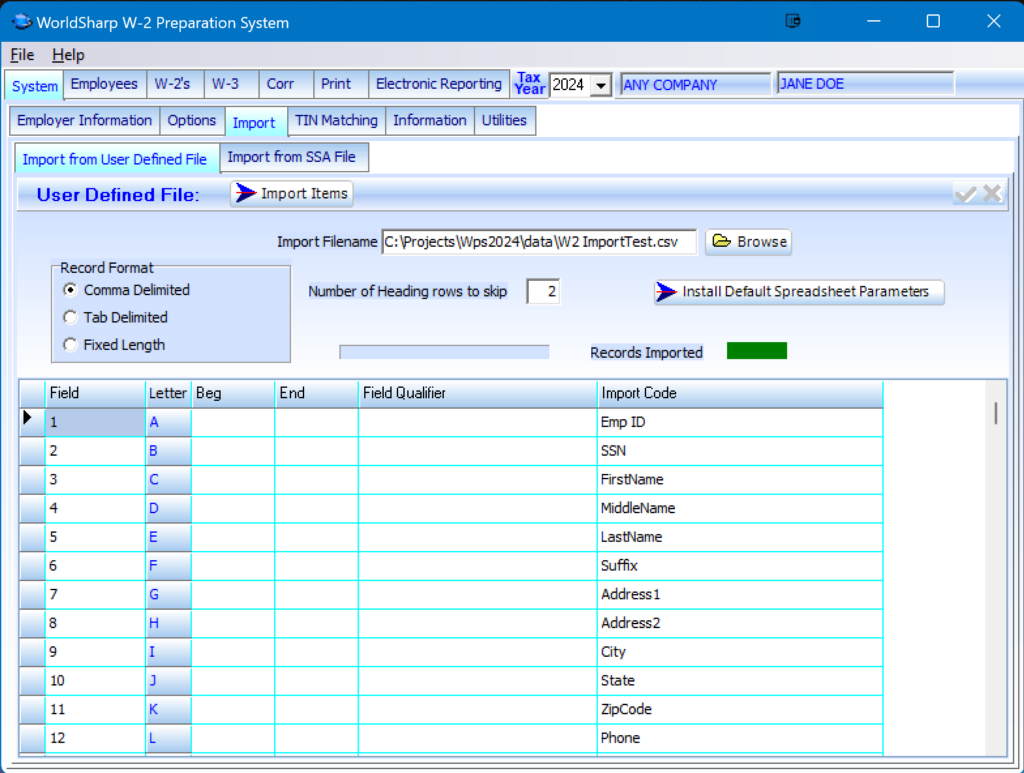

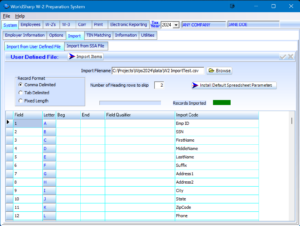

W-2 Importing (User-Defined File)

This screen enables the operator to import W-2 form data from a CSV file. A provided template includes columns for each required field, simplifying the process. By using the template, the operator can easily set all parameters with a single button press. Alternatively, files with custom column arrangements can be imported by manually mapping the parameters to the appropriate fields.

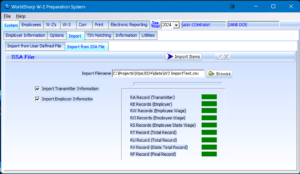

W-2 Importing (SSA File)

This screen allows W-2 data to be imported from a file previously created for submission to the Social Security Administration (SSA). Operators should note that files prepared for SSA submission may not contain all the fields required to print complete W-2 forms, and additional data entry may be necessary.

Hardware Requirements

- Memory: 2GB minimum.

- Disk Space: 100MB for installation and most data files. Additional space may be required for larger datasets.

Software Requirements

- Operating System: Compatible with Windows 7, 8.1, 10, 11, and all Windows Server versions (both 32-bit and 64-bit).

- PDF Reader: Required to view IRS instructions or system-generated documents. Adobe Reader or similar software is recommended.

- Word Processor: The user manual is available in Microsoft Word format and requires Microsoft Word or a compatible word document reader.

- Database:

- The system uses SQL Server Compact version 4.0, which will be installed automatically during setup if not already available.

- For advanced multi-user setups, the SQL Server Option requires Microsoft SQL Server 2008, 2012, 2016, 2017, 2019, or later.

- Microsoft .NET Framework: Version 4.0 or later is required and will be installed if necessary during setup.